5 Stocks Facing A Big 2023

These five companies face a year of real significance.

(Author’s note: This is the third installment in our year-end series reviewing 2022 and, now, taking a look toward 2023. From here, we’ll return to our regular schedule starting with an actionable deep dive on Sunday morning.)

We’re not in the business of making macro predictions here at Overlooked Alpha, nor is my personal investment strategy driven all that much by broad market forces. But were I to take a stab at what the S&P 500 does here in 2023, I’d wager: not much.

From here, 2022 looks like a significant and much-needed correction. Prices at the beginning of 2023 appear broadly correct. It was pretty easy to spot bubbles in 2021. It’s not terribly easy to spot screaming buys right now. Based on what we know now, it’s actually somewhat difficult for me to see a path this year to +20% or -20% for the market as a whole.

I’m in the minority in that opinion. For many, a volatile 2022 would seem to suggest the possibility of a sharp rebound in 2023 (perhaps with a boost if the Fed pivots) or a continued decline (perhaps with a shove if the Fed doesn’t). The options market also disagrees. Straddle pricing suggests a close to 20% move for the S&P 500 this year, and over 20% for the tech-heavy NASDAQ 100.

All that said, for many individual stocks, this is a year of significant importance and likely significant volatility.1 As of right now, it seems likely that public companies will face at least a degree of stability in 2023. That comes after three years in an external environment that changed quickly, violently, and often.

For many companies, the question will boil down to whether their businesses are as strong as they looked in 2021, or as weak as they appeared the following year. For others, valuation remains an intense debate. The range of estimates of normalized earnings remains exceptionally wide. For these five companies, in particular, 2023 looks like a key year.

Match Group

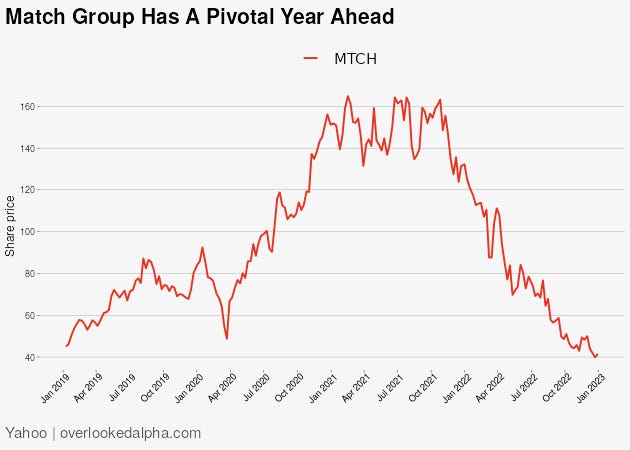

Much of the 2022 decline in tech stocks was driven by multiple compression. Somewhat surprisingly, Match Group MTCH 0.00%↑ was no exception.

This is a tech stock, yes, but it’s a mature name rather than a speculative one. Yet, as with much more speculative names, the market’s judgment of future growth moved dramatically in 15 months. At MTCH’s October 2021 peak, on an enterprise basis, the stock traded for right about 50x eventual full-year 2021 Adjusted EBITDA (which Match now calls Adjusted Operating Income). The current multiple to 2022 Adjusted EBITDA, based on Q4 2022 guidance, is 14x.

Admittedly, that guidance implies full-year profit growth of ~5% or so this year, a disappointing result which in turn explains some of the multiple compression. And an unofficial outlook for 2023 suggests revenue growth of 5% to 10%, including declines at legacy brands like Match and Plenty of Fish.

At the same time, Hinge is growing nicely and the possible combination of defensiveness and growth for Match Group as a whole can still exist. There’s still a world in which Match is something close to what investors believed it was in 2021, even if a 50x multiple seems highly unlikely to ever return.

Straddle pricing in the options market suggests a move of over 40% this year. Whichever way the stock goes, in retrospect it will no doubt look obvious. Either investors irrationally dumped MTCH amid a broad sell-off in “pandemic winners” and a brief pause in bottom-line growth — or they wisely saw that slowing growth as the first sign of a business losing its dominance and a market losing its pandemic-driven steam.

Six Flags

In August, we highlighted the contrarian bull case for Six Flags SIX 0.00%↑. Amid a banner 2022 for the theme park industry, Six Flags had badly underperformed. But the argument for SIX was that the company had struggled not because of structural failures, but because of a strategic change by management.

New chief executive officer Selim Bassoul has argued that his company’s parks have become day care centers for teenagers, thanks to discounted season park and dining pass prices. And so Bassoul has led a move toward “premiumization”, in which Six Flags gets fewer guests paying a higher price for a better experience. From management’s perspective, soft 2022 results (through the first three quarters of 2022, revenue and Adjusted EBITDA both are down 9% year-over-year) are the expected, and required, result of the first step of this strategy.

Last month, at The Bear Cave (subscription required), Edwin Dorsey laid out a bear case for SIX stock that was anything but counterintuitive: the strategy already is a failure. As Dorsey pointed out, customers and employees are up in arms at the changes.

Customer complaints to some degree are the proverbial and literal cost of doing business here. The people who literally made TikToks on how to live off the Six Flags dining pass probably aren’t happy about any changes. But employee concerns, highlighted in a long Reddit thread (that also includes more sober customer comments) carry some weight.

It’s still early, however. The second step of the strategy includes investments that should bear fruit in 2023. But the strategy has to absolutely show some signs of progress this year, including in profit margins. 2022 was a reset year that, as Dorsey points out, caused a good deal of friction. In 2023, Six Flags needs to see some benefit.

Add in an activist investor pushing for real estate monetization and this is a big year for Six Flags and for SIX stock. Ahead of that year, we’re still backing our call from August (SIX is actually +4%) and I’m still personally long, but we will be watching closely.

Spectrum Brands

To anyone paying attention, it’s blindingly obvious that this is a big year for Spectrum Brands SPB 0.00%↑. 2023 will see resolution on the planned sale of the company's Hardware and Home Improvement business to Sweden's Assa Abloy, which is facing an antitrust lawsuit from the U.S. Department of Justice. But, thanks to a timely suggestion from one of our readers, we’ll take the opportunity to provide an opportunity on our coverage of SPB back in early October.

At the time, we thought SPB was an intriguing, albeit high-risk, bet on the deal actually going through. Assa Abloy had reiterated its commitment to getting the deal done, with Reuters reporting the company was considering the sale of two lock brands to satisfy regulators. And while results for the remaining three business units were relatively ugly, at $42 there was a case that the myriad challenges (input cost inflation, retailer overstocking, demand pressures, etc.) were close to priced in.

Since then, SPB has gained 45%, as both sides of the story have largely played out. In early December, Assa Abloy indeed sold its Emtek brand and its Smart Residential business to Fortune Brands Innovations FBIN 0.00%↑ for $800 million. Spectrum in response issued a statement that the sale "will fully and completely resolve any conceivable competitive concerns." SPB rocketed 26% higher on the news.

On the other hand, the remaining business continues to face challenges. Fiscal Q4 results (which exclude the HHI segment) in mid-November missed consensus estimates on both lines after a huge whiff in Q3. Importantly, guidance for FY23 (ending September) looks soft.

Spectrum is guiding for revenue to rise low single-digits in a still-inflationary environment (admittedly with a headwind from currency). An expected low double-digit increase in Adjusted EBITDA sounds more promising, but given cost cuts and an easy compare, looks somewhat disappointing. Spectrum’s outlook in fact suggests Adjusted EBITDA is roughly equal, and maybe even below, that of three years earlier. (A 12% rise in FY23 would get to $317 million against $324 million in FY20.)

In that context, SPB probably needs the deal to close to see real upside in 2023. The post-Q4 enterprise value sits at $5.45 billion; Spectrum said at the time of the deal that it expected ~$3.5 billion in net proceeds from the transaction, which includes the use of net operating loss carryforwards to shield some cash taxes resulting from the gain on sale.

In a scenario in which the deal goes through, then, even after the gains SPB is trading at ~6x FY23 Adjusted EBITDA. (Pro forma EV of ~$1.95B vs pro forma Adjusted EBITDA of ~$317M.) Move that multiple to the ~8x assigned to FBIN and Central Garden & Pet CENT 0.00%↑and the stock gains another ~25% to the $75 range.

In a deal-break scenario, SPB still seems reasonably attractive. A $500 million termination fee appears likely to be shielded entirely from tax, moving pro forma EV under $5 billion. We can calculate HHI EBITDA2 from the company’s reported net leverage figure, which includes that business. Assuming a flat performance y/y for HHI in FY23, in this scenario SPB is still trading below 8x this year's consolidated EBITDA (~$580M) at expected year-end enterprise value (call it $4.4B, which accounts for an expected $500 million-plus in cash inflows, mostly due to the termination fee).

On paper, then, there is perhaps the same “heads I win, tails I don’t lose much” scenario at $60 that seemed to exist at $42. But that case now, much more than it did in October, requires the company to actually hit its marks.

Spectrum did not do so in fiscal 2022. Full-year results badly disappointed relative to initial guidance. After Q4 FY21, Spectrum forecast a modest increase in Adjusted EBITDA. The company instead posted a 28% decline. Inflation and currency obviously skyrocketed relative to broader expectations in late 2021, but there is a history of disappointment here, even before the pandemic. SPB was halved between 2017 and 2019, thanks to below-market performance that led to the removal of the company’s chief executive officer in 2018.

So there is still a case here, but investors need to trust either the DOJ or Spectrum itself (and probably both). It’s not hard to wonder if there are higher-reward opportunities elsewhere for those willing to take on a similar amount of risk.

Lovesac

Lovesac LOVE 0.00%↑ began as a manufacturer of bean-bag chairs before pivoting its focus toward its modular couches called “Sactionals”. A 2018 initial public offering saw LOVE stock close at $24. It ended 2022 just above $22:

The decline from 2021 peak has been driven by challenges facing so many companies at the moment: falling profits due to a pandemic-driven 2021 peak and inflationary pressures in 2022.

LOVE provides a magnified case of those crosswinds, however. Revenue continues to increase at a rapid pace (+37% through the first three quarters of 2022), thanks to both store count expansion (+40%) and same-store sales growth (+25.7%)3. But margins have been crunched. Adjusted EBITDA margins were 7.8% in the first nine months of 2021, and just 2.9% over the same period in 2022.

There’s a question, then, of whether this can consistently be a real business. Revenue growth has been strong, but benefited from post-pandemic spending in 2H 2020 and full-year 2021, plus the rapid store count expansion last year. And we’ve been here before. In the 2000s, Lovesac opened more than 60 stores, and then filed for bankruptcy in 2005.

This is a different business: the Sactional, released the year after the bankruptcy filing, now accounts for ~90% of revenue. But there’s still a question of what Lovesac’s structural profitability looks like. More than a few traders remain highly skeptical:

source: YCharts

This year, with easier comparisons and (presumably) stable inflation, Lovesac will likely prove those shorts right or wrong.

Shopify

Our first GIF seems fitting for this chart:

source: finviz.com

In three sessions after Shopify SHOP 0.00%↑ released first quarter results in May, SHOP declined 30%. In the nearly eight months since, the stock has traded sideways.

In context, that performance is actually reasonably solid. Over the same stretch, Amazon AMZN 0.00%↑ is off 22%, and the NASDAQ 100 is -11%.

But that performance also sets up a 2023 where the market comes to a broader decision on what Shopify actually is.

Is it a niche business (admittedly a very large niche) likely to face seller and customer churn after the market volatility of 2020-2022? How many small and medium businesses are going to actually create consistent livelihoods on the platform over the long haul? Are international efforts (revenue ex-U.S. was 36% of the total in 2021) going to succeed?

Can penetration in large merchants take hold? Shopify talks a good game, but its new customer list discussed on the Q3 call (Panasonic, shoe companies Cole Haan and Converse, Greenies pet treats) is not exactly blue-chip.

Most importantly, is it really a competitor to Amazon, particularly on the logistics front? That was the case that, along with broad market optimism, sent Shopify to a $200 billion (!) market cap in late 2021.

The options market suggests the market is going to come to some kind of decision. After eight months of sideways trading, straddle pricing implies a move of more than 50% by the January 2024 expiration. As with so many names on this list, it’s figuring out the direction of the move, not the size, that seems to be the hard part.

As of this writing, Vince Martin is long shares of Six Flags. He has no positions in any other securities mentioned.

If you enjoyed this post please do us a huge favor and hit the heart button! ❤️

Disclaimer: The information in this newsletter is not and should not be construed as investment advice. Overlooked Alpha is for information, entertainment purposes only. Contributors are not registered financial advisors and do not purport to tell or recommend which securities customers should buy or sell for themselves. We strive to provide accurate analysis but mistakes and errors do occur. No warranty is made to the accuracy, completeness or correctness of the information provided. The information in the publication may become outdated and there is no obligation to update any such information. Past performance is not a guide to future performance, future returns are not guaranteed, and a loss of original capital may occur. Contributors may hold or acquire securities covered in this publication, and may purchase or sell such securities at any time, including security positions that are inconsistent or contrary to positions mentioned in this publication, all without prior notice to any of the subscribers to this publication. Investors should make their own decisions regarding the prospects of any company discussed herein based on such investors’ own review of publicly available information and should not rely on the information contained herein.

It admittedly seems contradictory to argue that market indices won’t move much while many individual stocks will. I’d argue that a) that’s how relatively quiet broad market years pretty much always work and b) more importantly, some companies facing pivotal years will step up to the challenge will others wilt, resulting in a modest net impact for the market as a whole. Again, I could be very wrong on multiple counts here.

For HHI, FY22 Adjusted EBITDA was $263 million, down about 7% year-over-year.

The figures for total revenue, comps, and showroom count don’t seem to add up, but the store count expansion hasn’t benefited the entirety of year-to-date results. Lovesac went from 174 stores to 189 just in Q3 alone.

All interesting; I find SPB particularly so.