A Primer On Enovix Corp.

Battery developer ENVX has got investors talking. We take a look at the market's newest battleground stock

Highlights:

Enovix has quickly become the subject of intense debate. Bears see a promotional company set for failure; bulls see a potential generational buy.

Ironically, both cases spring from the same event: a disastrous third quarter release, which was accompanied by a significant strategic shift.

The truth seems to be somewhere in the middle. Up 180% since January, ENVX isn’t an easy buy — but it looks far too dangerous to short.

There’s no paywall on today’s piece as we feel this is a company investors need to know more about. If you enjoy this analysis, please share it widely!

It’s easy to see why Enovix ENVX 0.00%↑ has become a battleground stock. Both bulls and bears have narratives that they can grab with an almost religious fervor.

To bulls, Enovix offers potentially transformative technology, impressive leadership and a massive addressable market. One well-known shareholder has called that market “infinite”. Perhaps as importantly, ENVX stock also has a high short interest: about 25% of the float (and ~20% of shares outstanding) is sold short. That short interest clearly provides some fuel for the online fire behind ENVX at the moment.

To bears, ENVX is a battery stock — and that might be enough. Enovix’s technology aims to displace lithium-ion batteries, which have been used going back to the 1990s1. Since then, potential alternatives have been proposed over and over again; pretty much every one has failed, which is precisely why lithium-ion batteries remain king. A123 Systems was the biggest initial public offering of 2009, and bankrupt barely three years later. Startups like Envia and EnerDel crashed. More recently, publicly traded companies like QuantumScape QS 0.00%↑, Solid Power SLDP 0.00%↑, and — until this year — Enovix itself have proven to be profitable shorts.

But skeptics can also point to problems beyond the industry’s history. Even bulls agree that Enovix’s execution in the past was abysmal. Looking forward, bears have raised questions about the company’s technology, and pointed to a more competitive market than Enovix backers admit. Like QuantumScape and Solid Power, Enovix went public via the de-SPAC route, and that alone raises questions in some eyes.

The respective viewpoints lead to very different visions of the future. Bulls see riches, while bears see a zero (or maybe a couple of bucks a share). That in turn has led to the unfortunately-too-common online nastiness between the two sides.

But that nastiness aside, this is a fascinating story.

source: Enovix home page

The Promise And Peril Of Silicon Anodes

Traditional lithium-ion batteries use a graphite anode. But the performance of graphite is starting to bump into its energy-density ceiling. As an Enovix executive discussed on a podcast last year, the various aspects of smartphones — processing power, memory, storage, etc. — are generally growing at a 10% to 40% clip annually. Battery performance, however, is improving at a roughly 4% rate. And so the battery is set to become an actual limiting factor on the performance of smartphones and other consumer devices.

What is needed is a material that has more energy density than graphite, which in turn can create greater capacity for the battery and potentially faster charging. Silicon is one of those materials: its energy density is as much as ten times that of graphite.

Silicon’s advantage has been known for some time: the first silicon-anode battery cell was developed in 1976, seven years before graphite anodes were first reported. But silicon has significant disadvantages as well. Most notably, silicon expands up to three times its size when it mixes with lithium in a so-called “conversion reaction”. If a modern smartphone battery was made with a silicon anode, upon charging its back cover would literally pop off. Even if that pressure were somehow removed, conversion reactions will steadily degrade the silicon, leading to unacceptable battery life.

The Enovix Proposition

Enovix was founded in 2007 — but not by chemical engineers. Instead, as the company writes in the most recent 10-K, the founding team had “expertise in three dimensional (“3D”) architectures” developed through working on hard disk drives and systems for semiconductor testing. And so Enovix, aware that the chemical properties of silicon and lithium could not be changed, instead focused on the architecture of the battery.

The company’s new design replaced the so-called “jelly roll” typically used in the cells of lithium-ion batteries. In a “jelly roll” architecture, large anodes and cathodes sandwiched a separator made of plastic. The Enovix architecture, however, was based on short anodes and cathodes positioned next to one another, with individual separators between:

source: Enovix / Rodgers Silicon Valley Acquisition Corp. merger presentation, February 2021

Simply using more of the same space (see the blank space in the corners of the “jelly roll” battery, for instance) provided benefits. But the Enovix design also positioned the anodes facing the short side of the battery (the 3mm side in the slide above). This in turn substantially limited the pressure that a traditionally-placed silicon anode — which would face the long side of the battery — created.

The difference is stunning. Silicon anodes in a “jelly roll” architecture would create force of as much as 3,400 pounds — again, enough to cause the battery to literally break apart. The Enovix design using the same silicon anodes, however, creates just ~210 pounds of force.

Enovix could manage that far-lower level of force simply with a thin stainless steel “constraint” around the battery. Furthermore, the constraint applies uniform pressure on the silicon particles themselves, minimizing the conversion reactions that lead to degradation of the anode and problematic cycle life.

In other words, as Enovix sees it, the architecture solved the problem that chemists simply could not. It allows for the advantages of silicon anodes — which, for smaller batteries, can at least double performance — without their downsides. And so the company is set to deliver batteries that outperform lithium-ion alternatives on all fronts: energy density, charging speed, and cycle life.

Enovix Stumbles

At least that was the pitch when the SPAC merger closed in July 2021. And for most of the next 15 months, Enovix seemed to be on track. Between Q2 2021 and Q2 2022, the company’s “revenue funnel” of engagements with potential customers, active designs, and design wins increased from $1.17 billion to about $1.5 billion. Over that period, Enovix added three new design wins, bringing the total to eight, including its first potential entry into the medical device market.

In the second quarter of 2022, Enovix shipped cells to customers and recognized its first product revenue (the revenue was less than $100,000, but still), fulfilling a target it had set when the SPAC merger was announced. In its Q2 shareholder letter, the company talked up activity with “strategic accounts,” or tech companies with a market cap over $200 billion, as well as progress through qualifications with the U.S. Army. All the while, co-founder and chief executive officer Harrold Rust touted continuing manufacturing improvements with Gen1 (1st-generation) equipment at Fab-1 (the first fab, in Fremont, California), while projecting significantly improved yield, production, speed, and cost from Gen2 equipment and new facilities.

For the most part, the market believed in the optimism. ENVX saw volatile trading, and briefly dipped below its $10 merger price in July 2022. But given investor attitudes toward pre-revenue, de-SPACs — many of which had dropped below $5 or worse — the sell-off wasn’t entirely surprising. And the Q2 report in August sparked renewed confidence that drove shares back above $20, making it one of the best performers of the SPAC group (an exceptionally low bar, admittedly) to that point.

But the third quarter report in November changed the story — because Enovix changed its go-to-market strategy. Instead of using Gen1 equipment to serve major accounts, as had been the plan, Rust said the company essentially would go all-in on Gen2. This was framed mostly as a response to the improved performance of Gen2, but in the Q3 shareholder letter Enovix admitted to “slower-than-expected improvements on our Gen1 manufacturing equipment”. ENVX plunged 41% the next day.

Pressing The Short

There’s a straight line from that Q3 report to the current, intense, debate over ENVX. For both bulls and bears, the strategic decisions announced in the report provide a foundation for their respective cases.

This year, there have been three public short reports on the stock: from compound248 at Value Investors Club (article requires a free account to read), Pig Farmer Capital2, and ESG Hound. Each report includes a version of the same point: if Enovix couldn’t get Gen1 manufacturing to work, who in their right mind would back them to succeed with Gen2?

It’s an important point, because where Enovix has (so far) failed is precisely where battery companies historically have failed. Few, if any, of the challengers to the three-decade reign of lithium-ion have been outright frauds. Most managed to accomplish what Enovix has done: build products on an R&D line which show better performance than existing alternatives.

The catch, however, is replicating that performance at volume, with speed, and at costs and yield that can lead to sustained profitability. It’s the latter issue that seemed to trip Enovix up with Gen1, and the compound248 piece quotes a former employee who argues that the architecture may prevent the company from ever achieving acceptable yields at reasonable cost3.

The skepticism toward Enovix’s ability to produce at scale is tantalizing because it matches precisely with what Enovix itself has said. The company said it had a potentially transformative technology; it said it would manufacture that technology at scale; for all intents and purposes, it couldn’t do so.

When Enovix announced its SPAC merger in February 2021, it projected $176 million in revenue this year. By last year’s Q2 report in August, the company expected to produce “single digit million units” from Gen1 lines this year — implying a 90%-plus miss relative to the 2021 projections (unit prices are in the $5-$10 range for the initial products). Current guidance is 180,000 units — which represents maybe $1 million in revenue.

Enovix’s experience with volume manufacturing so far has been nearly a complete failure. Again, that’s not a shock: it mimics the experience of so many companies in the space whose stories ended with bankruptcy, or something close to it.

Under New Management

Yet that same Q3 report is a crucial part of the bull case as well. The effects of the struggles at Gen1 have created key aspects of the story now told by ENVX adherents.

Third quarter results were released on November 1. Six days later, T.J. Rodgers was named executive chairman. Rodgers, as the name suggests, had led Rodgers Silicon Valley Acquisition Corp., the SPAC with which Enovix merged in 2021. Post-merger, he was the chairman of the Enovix board — but even before the merger, he had been a personal investor in the company as well as directing an investment into the company from Cypress Semiconductor, where Rodgers was CEO.

Rodgers was not just CEO of Cypress; he founded the company, and grew it over three-plus decades before it was sold to Infineon Technologies (IFNNY) for nearly $10 billion. In early 2017, just after his retirement from Cypress, Rodgers made a strategic investment in solar supplier Enphase Energy ENPH 0.00%↑ and joined the Enphase board. ENPH stock is up 152x since his investment was announced. (To be clear, ‘152x’ is not a typo.)

Upon adding “executive” to his title at Enovix in November, Rodgers promised a more hands-on approach, and pre-emptively rebutted the bear case that would be made the following year [boldface in original]:

I have heard from many investors that the delay and projected underperformance of Fab-1 must be the result of some catastrophic technology problem. For the record: Fab-1 is going to work and ship a lot of batteries to our customers ‒ period.

Three days later, Enovix added a new chief operating officer with extensive experience, including 23 years at Advanced Micro Devices AMD 0.00%↑. And in late December, Rust retired and was replaced as CEO by Dr. Raj Talluri, a veteran of Micron MU 0.00%↑ and Qualcomm QCOM 0.00%↑.

It’s precisely these three new executives that now underpin the most common bull case. In the eyes of Enovix shareholders, these three highly accomplished men not only validated Enovix’s technology by choosing to work at the company, but validated the argument Rodgers made in November: that Fab-1 does not have “some catastrophic technology problem,” but that the delays instead were the result of an “unacceptable execution problem”. Talluri publicly expressed this view in April, telling Forbes that “when I saw the issues, I was like, okay, this shouldn’t be this hard to do.”

The history of the three men matters: combined, they have well over a century of experience in semiconductors4. That experience might seem unusual for a battery company, but, again, this is a battery company that claims its competitive advantage is in architecture, not in chemistry. And architecture is what chip executives know exceptionally well. As a sell-side analyst told Forbes, “The problems they’re dealing with are problems people in semiconductors deal with all the time.”

One Point To Each Side

To our eye, each side has one major point in its favor.

The qualitative argument made by ENVX bulls absolutely seems to have some basis in fact. There is at the least a very real possibility that Gen1 problems were driven by execution, and not the underlying technology; the measured Forbes piece mentioned above quotes both experts and analysts who argue, essentially, that Enovix’s technology is the real thing.

Whether Enovix can, or will, execute in the manner required admittedly is a different story. Timelines for volume production now have been pushed out to the second half of next year. In March, Enovix agreed to locate Fab-2 in Malaysia in return for a “significant financial stake” in the first line. There’s still a lot that can go wrong, and after Gen1 struggles this has to be at least to some extent a “show me” story.

Still, the optionality here is real. Loop Capital last year said the company had a path to a market cap of $75 to $80 billion by 2030. That was before the production disappointments, admittedly, but the fact that such numbers could be created, even in theory (and publicly in a bear market!) gives a sense of the blue-sky outcome. A company that transforms batteries for consumer products, medical devices, and (eventually) electric vehicles absolutely can be a 25-bagger.

The question, however, is how likely that optionality really is — and what a more measured outlook might suggest, even if the technology does work. Pig Farmer Capital, building on work from the aforementioned VIC short pitch, pointed out that Varta (VARTY on the OTC markets; VAR1 on the Frankfurt exchange) won the contract to manufacture AirPods for Apple AAPL 0.00%↑ — and its stock is down over the past five years.

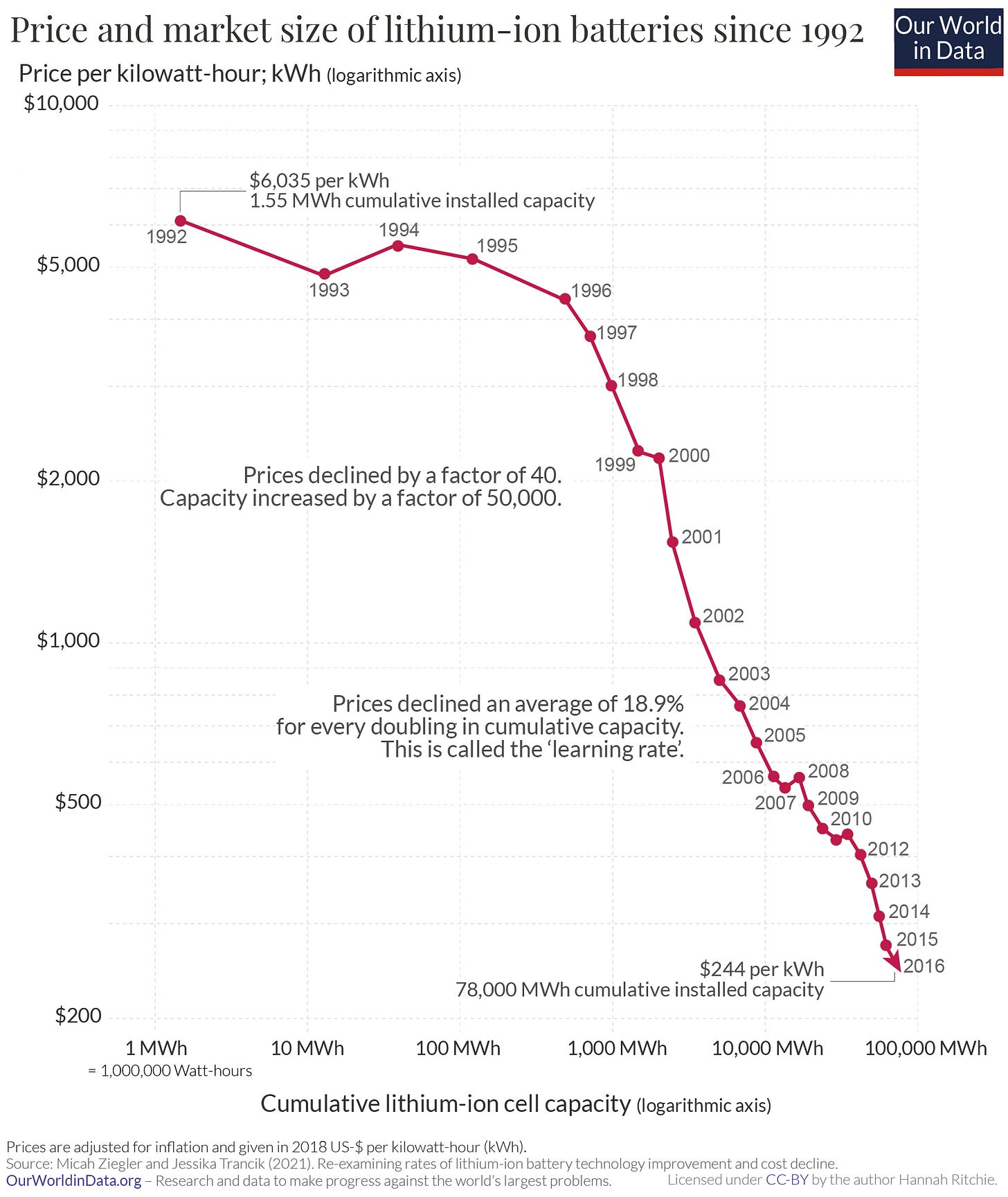

Simply put, the battery business is difficult. Enovix has already pulled down profitability expectations (after guiding for 30% operating margins in the past). Prices in the industry historically fall over time:

source: Our World In Data

In part due to that fact, Enovix’s original strategy was to target the consumer business first, where it didn’t need billion-dollar factories, wouldn’t directly face the likes of QuantumScape, and would able to garner premium pricing in part because battery cost was a small portion of a manufacturer’s overall expense base5.

Even if that strategy works, competitors are coming. Fellow de-SPAC Amprius Technologies AMPX 0.00%↑ is also working with silicon anodes, though its ‘nanowire’-based batteries likely aren’t a good fit for the consumer markets. Startups like NanoGraf and Enevate are moving toward production, and the majors continue to work with silicon as well.

Those competitors raise questions about profit margins, return on invested capital (Enovix is spending $75 million a line), and what multiple the market is really going to pay for a business that wins in a couple of markets but doesn’t necessarily dominate any of them.

And, importantly, they also raise the prospect that by the time Enovix gets to EV batteries, a silicon-anode alternative will have already gained significant traction in that market. That would cut off the path to the multi-bagger upside that excites so many ENVX bulls at the moment.

On The Fence

And so there’s a way to see ENVX as somewhere in the middle of the two warring camps. There is some technology here, definitely. But even if Enovix can make that technology work, it’s far from certain that there’s material upside from the current market capitalization above $3 billion.

Forced to choose, we’d probably lean long, despite our general skepticism toward these kinds of plays. Enovix absolutely is a different story than it was in early November. History suggests a bet on Rodgers and Talluri has a good chance of paying out. Both men have the experience to understand the challenges ahead of the company, and both men are acting completely as if they believe those challenges can be solved.

Meanwhile, it does seem odd that ENVX short interest has risen so far this year (it’s in fact more than doubled). A short here not only seems close to suicidal, but somewhat bizarre.

What makes so little sense about shorting ENVX here is that the near- to mid-term risk/reward is skewed completely in the wrong direction. Assume, for instance, that an investor knew that the Gen2 efforts were going to fail. In that scenario, ENVX likely heads to zero at some point. It’s possible the company ekes out a couple bucks per share for its technology, but history suggests management teams don’t stop near the end to salvage a little bit of shareholder value.

But even with that knowledge, should investors necessarily short now? Doing so means standing in front of a story stock that is a) gaining momentum and, more importantly, b) where the key debate is not going to be resolved for several quarters. It’s not quite right to argue that if the stock goes from $20 to $0, or $8 to $0, a short makes the same 100% return6, but the bear case here is probably ENVX at $3 at the most. There is plenty of meat on the proverbial bone once the story starts to break. And so there isn’t enough reward for trying to time exactly when that break will occur.

Admittedly, there’s one potential downside catalyst on the horizon: Enovix likely will need to raise capital via an equity sale, and perhaps a short could argue that the announcement would pop the ENVX balloon. But that seems a thin reed, and after the rally since January it’s possible investors see an equity raise as good news, clearing out any potential capital concerns and paving the way to Gen2 production and further upside in the stock.

There have been more than enough of these stories over the past few years to prove the folly of trying to ‘outsmart’ bulls who truly believe in the stock. As long as bulls see riches in the long term, ENVX stock can provide them in the near term.

As of this writing, Vince Martin has no positions in any securities mentioned.

If you enjoyed this post you can help us by clicking the heart ❤️

Disclaimer: The information in this newsletter is not and should not be construed as investment advice. Overlooked Alpha is for information, entertainment purposes only. Contributors are not registered financial advisors and do not purport to tell or recommend which securities customers should buy or sell for themselves. We strive to provide accurate analysis but mistakes and errors do occur. No warranty is made to the accuracy, completeness or correctness of the information provided. The information in the publication may become outdated and there is no obligation to update any such information. Past performance is not a guide to future performance, future returns are not guaranteed, and a loss of original capital may occur. Contributors may hold or acquire securities covered in this publication, and may purchase or sell such securities at any time, including security positions that are inconsistent or contrary to positions mentioned in this publication, all without prior notice to any of the subscribers to this publication. Investors should make their own decisions regarding the prospects of any company discussed herein based on such investors’ own review of publicly available information and should not rely on the information contained herein.

As Enovix notes in its 10-K, Sony SONY 0.00%↑ in 1991 developed lithium-ion batteries for its camcorder (for younger readers, a handheld video recorder).

The name is a clear poke at Marc Cohodes, a well-known short seller who has become a vocal ENVX bull.

The issue, per the former employee, is the distance between the individual strips within an Enovix battery; to get them close enough for the benefits of the architecture to be realized requires “equipment [that] will be so slow and so expensive there will never be an ROI [return on investment] on it”.

Late last month, Enovix added a new chief financial officer as well, most recently of Micron.

Bears have argued, however, that Enovix only has an advantage in smaller batteries; PFC makes a solid case that its architecture-driven edge in EVs will be nonexistent or close.

The same amount of margin dollars can cover more shares on the way down, so going from $20 to $0 is more profitable than going from, say, $8 to $0, assuming the position size is held constant in dollars rather than shares.

Great post. I would challenge the assertion on short risk however. The company is facing a binary event (Malaysian Fab start up). The upside is priced in. The downside is not. The short interest is a reflection of this. Just my two cents

I missed out on this one. Definitely great analysis