Bed Bath & Bankrupt

If BBBY is the beginning of the end, we can all breathe a sigh of relief. It likely won't be that simple

(Author’s note: This article contains thoughts on a topic that alternately frustrates and fascinates me. It’s a bit of a departure from our normal work which is why there’s no paywall on today’s piece.)

At some point soon, Bed Bath & Beyond stock will be zeroed. That day will represent a milestone.

As far as I can tell, BBBY (or BBBYQ, as it will be called, given the bankruptcy filing last week) is the first ‘meme stock’ in which shareholders will know they have lost the entirety of their investment.

source: Finviz.com

AMC Entertainment is down big. A good number of GameStop shareholders are in the red. Meta Materials preferred stock (MMTLP) is almost certainly worthless (its shareholders might even end with up negative returns after-tax) but its owners persist in seeing a massive short squeeze on the way once trading in the stock reopens (which it won’t).

Some of the older meme stocks like Koss or Express are doing their best Walking Dead impression, but zero still hasn’t arrived. (It may be sooner than later for EXPR, however.)

The newer meme plays (Mullen Automotive being one example) are long-term zeroes, but for now are still operating companies.

For all of those names, there are still hodlers, as the kids call them, keeping the faith that the MOASS (mother of all short squeezes) is on the way and that the downward manipulation will end. Just as importantly, there’s still a reason for those communities to exist.

MMTLP ‘shareholders’ (they no longer actually own anything) can fund their billboards and AMC ‘apes’ can go to their screenings. In contrast, the BBBY influencers and meme-makers will have nothing left to discuss, no grievances to air, no hopes of life-changing wealth (or even enough to fund a take-out dinner).

And so it’s fair to wonder if the Bed Bath & Beyond bankruptcy might represent the first step towards the end of the meme stock craze. Because it’s the first time that traders in one of these plays will be told, unequivocally, that it’s over. Unfortunately, it seems unlikely to be so simple.

The Original Meme Stock

Clearly, the existence of “meme stocks” began with the rally in GameStop1 during late January 2021, an incredible rally2 that became worldwide news. But the predecessors of that rally no doubt go further back.

Some analysts have pointed to the Great Financial Crisis as being the initial catalyst. A 2021 article in Business Insider compared the “GameStop mania” to Occupy Wall Street (a two-month protest in 2011 against the government’s response to that crisis) as a “populist movement threatening to disrupt the financial system.”

This epic post predicting a MOASS in GME by Ben Wehrman, profiled last year by the Wall Street Journal, cites the 2008-09 market crash as a cause. Wehrman claims that “the 2008 financial crisis…was completely the fault of those very same hedge fund cronies that are tied up in the GameStop fiasco today.” He adds that “GME is the ultimate opportunity to deliver proper justice” to those funds.

To my eye, that explanation looks like bullsh—. It’s a claim tacked on after the fact by media members excited about a huge story, and by traders looking to add dramatic flourishes to their own efforts. It’s a claim with essentially zero evidence.

We know this because many posts at the WallStreetBets subreddit are still up, as are the articles and discussions on Seeking Alpha. As far as I can tell, no one who owned GME before late January 2021 is making these claims. On occasion, there are hints of meme stock grievance. There are a few complaints about market makers like Citadel, and references to a rigged game. But only a few such complaints.

Rather, the bull case prior to 2021 is relatively reasonable. It’s a fundamental case with several pillars — an operational turnaround, the involvement of Chewy founder Ryan Cohen, a pivot to digital sales, benefits from a new console cycle. The high short interest is the potential catalyst, not a sign of a broken system. For the most part, shorts are not seen as evil, but simply wrong. And as far as I can tell (though, to be fair, Reddit posts don’t always have a long shelf life), there’s zero talk of GME being about “justice” or fighting back against evil financiers. Instead, GME is seen as a way to make money, and, yes, to have some fun and make some memes, and maybe throw a proverbial punch or two along the way.

GME to MMTLP

The underlying aim of the 2020 cohort of GME investors — an exceptionally large group by normal industry standards, and one apparently strong enough to help drive a 334% rally in the stock over the second half of 2020 — was to be investors. They were by no means perfect investors but the shape of their efforts is familiar to anyone who has done her own fundamental research.

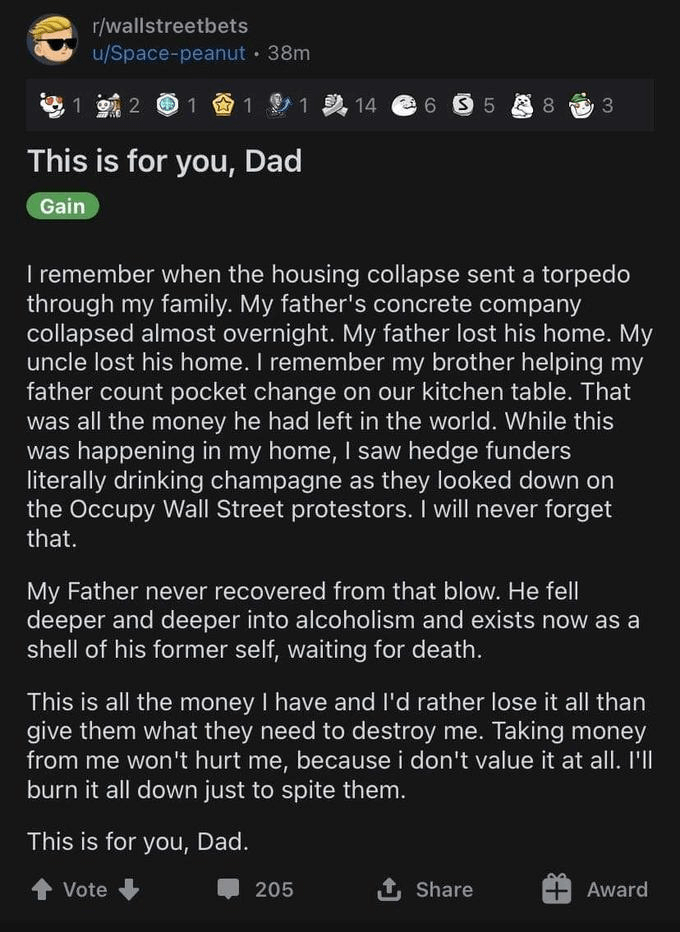

But when GameStop became literally global news in January 2021, and thousands of people piled in, the story changed seemingly overnight. Suddenly, there’s a viral post on Reddit about the grandness of the fight, one that is replied to with dozens of others telling the same tale:

source: Reddit screenshot via BenWehrman.com

This post is one of the first I could find that sounds like current commentary and it highlights a dramatic change. The online GME community, for lack of a better term, in 2020 and into late January 2021 was trying to make money. The community after the January spike was trying to be epic.

It seems impossible that such a significant shift could have happened so instantaneously, which perhaps is another reason why the “fighting against the system” narrative has taken hold. But we can look back and see: before late January (GME peaked on Jan. 28), there is nothing remotely akin to the conspiracy theories regularly being floated now.

That’s true for GME — which means it’s true for essentially every stock, since GME was largely the only meme stock (in our current sense of the word) that existed in mid-January 2021. None of these other names had any similar kind of community or intensity. I’ve written this before elsewhere, but if you run a Twitter search for “$AMC squeeze” before Jan. 1, 2021 there’s literally about 2-3 posts a month. That same search string now brings as many posts every hour.

To my eyes, there are two core reasons for this sharp shift. The first is that most investors who joined in, roughly, mid-January, wound up losing. This of course is not just true for GME. Most retail shareholders, past and current, in AMC, MMTLP, EXPR and others have either realized or unrealized losses. For many, those losses are significant (if on a relative basis).

Those losses create the need to build a narrative for the sake of justification. In that narrative, buying GME at $350 pre-split wasn’t a foolish attempt to chase a bubble as it was ready to pop. No, not at all. It was an act of rebellion. It was a shot at the establishment that had taken away so much, from someone who cares about money so little that they ran to their trading account when an opportunity to make that money seemed to arise. (And they would have gotten away with it, too, it wasn’t for those pesky Robinhood restrictions.)

After all, it’s easy to forget that the last ones into the frenzied January 2021 pool got absolutely smoked. GME actually crashed quite hard quite quickly: by Feb. 19, it had dropped 87% from its peak in just 14 trading days. AMC was more than halved. Cenntro Electric, which was then Naked Brand Group (ticker NAKD), fell more than 50% in two sessions. The pivot to intensely conspiratorial thinking is not that surprising given the intensity and speed of the losses for those that got in late.

From that point, of course the culprit seems to be social media. The earliest losers built up their narrative of manipulation and unfairness, and over time the algorithms did the rest. Indeed, we can see in the path from GME in 2020 to MMTLP in 2023 — whose community is so toxic that for safety reasons FINRA employees were told to work from home — the same path of polarization we see in our politics.

Short sellers go from being “greedy” in the “pigs get fed; hogs get slaughtered” sense to “greedy” in the manner of “buying regulators and committing crimes”. Discussions of fail to delivers and the threshold list turn into ‘synthetic shares’ and massive conspiracies. A mostly-fun battle against institutional short sellers, and a desire for a big score, morphs into grandiose opposition to the entire financial system, and claims (seriously) that single shares will be worth hundreds of thousands of dollars.

These claims are, to be blunt, extraordinarily stupid3. Simply think through the actual mechanics of the purported counterfeit shares. Who is selling these shares? It appears to be Citadel, but why are shorts buying them? AMC/GME/MULN shorts allegedly have created an illegal conspiracy including thousands of people4 — there isn't a workaround to the fake share problem?

source: finviz.com

If they're creating a parallel market centered around dark pools, why not just pick the price they want? If the shares are counterfeit, why is there any need to cover at all? Why release true fail-to-deliver and short sale volume data — or release it at all? Why is no one, anywhere, in the hedge fund industry trying to take the other side of the trade amid this downward manipulation — or trying to engineer the squeeze themselves?

One of the baffling things about the persistence of meme stocks is that the underlying theories are just so dumb, so full of holes, to anyone who knows even a little better. (Roaring Kitty never would have bought into this nonsense.)

But again, the core shareholder base of meme stocks doesn’t know much better. AMC and MMTLP aren’t for trading or investing. They’re a role-playing game, an online version of Dungeons & Dragons with financial stakes and a lottery-ticket component. They’re a way for the players to feel like they’re part of something, and the more epic that something is (and the more evil the purported ‘bad guys’ are) the better.

Whether This Matters And When It Ends

One question for the rest of us is whether this matters to the market as a whole. There’s little evidence that it does — and the disconnect was apparent almost instantly. While GME was plunging 85%-plus from its late January peak, growth stocks were in the last throes of a parabolic rally that would accelerate into mid-February5.

Again, this makes sense if AMC and MMTLP and their ilk simply aren’t investments. Of course there’s not going to be a consistent correlation with the market as a whole; these stocks are not part of the market.

Of course that also means that meme stocks are likely to be around for quite a while. Here’s Bloomberg columnist Matt Levine about GME on Feb. 1, 2021:

There have been bubbles, and corners, and short squeezes, and pump-and-dumps before. It happens; stuff goes up and then it goes down; prices are irrational for a while; financial capitalism survives.

But I tell you what, if we are still here in a month I will absolutely freak out. Stock prices can get totally disconnected from fundamental value for a while, it’s fine, we all have a good laugh. But if they stay that way forever, if everyone decides that cash flows are irrelevant and that the important factor in any stock is how much fun it is to trade, then … what are we all doing here?

We’re not criticizing Levine (we don’t do that around here under any circumstances). He himself has made light of this passage from time to time.

But the last sentence seems critical to understanding what meme stocks are now. They are precisely stocks in which “everyone decides that cash flows are irrelevant and that the important factor in any stock is” — well at this point not “how much fun it is to trade” (MMTLP does not look like fun, nor does even GME at this point), but perhaps “how compelling it can be to trade.”

And in a social media world, there will always be influencers (if you can call them that) who can create these compelling stories. They’re being egged on now by CEOs, who have figured out that if you hire Shareintel and put out a press release about naked short selling your stock will jump6. In many cases, this will allow you to sell more stock at a higher price to fund your ongoing losses. Everybody wins — except the people who believe you, of course.

And so, despite the opening to this article, we’re skeptical that the Bed Bath & Beyond bankruptcy is the beginning of the end for meme stocks. But, personally, I’m hopeful. Because the nonsense surrounding these stocks does matter, to real people, if not necessarily to the rest of the market. And that nonsense is destructive and unacceptable.

It’s not OK that employees for FINRA are facing threats. It’s not OK that meme stock participants are roping their children into their nonsense. It’s not OK that marriages are going to break up, and (I’d wager) people literally are going to die because they blew their savings chasing a payout promoted by those who are grifters, morons, or both. It’s not OK that Adam Aron and so many other CEOs play “wink wink” with anonymous Twitter users accusing thousands of real people of committing multiple felonies.

It is a toxic environment, and it needs to go away. I just have no idea how we are supposed to make that happen.

As of this writing, Vince Martin thankfully has no positions in any securities mentioned. He absolutely has no plans to change that.

💥 If you enjoy this content make sure to become a paid subscriber:

Disclaimer: The information in this newsletter is not and should not be construed as investment advice. Overlooked Alpha is for information, entertainment purposes only. Contributors are not registered financial advisors and do not purport to tell or recommend which securities customers should buy or sell for themselves. We strive to provide accurate analysis but mistakes and errors do occur. No warranty is made to the accuracy, completeness or correctness of the information provided. The information in the publication may become outdated and there is no obligation to update any such information. Past performance is not a guide to future performance, future returns are not guaranteed, and a loss of original capital may occur. Contributors may hold or acquire securities covered in this publication, and may purchase or sell such securities at any time, including security positions that are inconsistent or contrary to positions mentioned in this publication, all without prior notice to any of the subscribers to this publication. Investors should make their own decisions regarding the prospects of any company discussed herein based on such investors’ own review of publicly available information and should not rely on the information contained herein.

It does seem like the (in)famous Reddit community, r/WallStreetBets, was using the “meme stock” term before 2021, but that appears to have been an inside joke among the subreddit’s users.

Unadjusted for last year’s 4-for-1 split, GME opened the month at $17, peaked at $483 on Jan. 28, and closed the month at $325.

A first draft of this article had a ~700 word section detailing that stupidity. In the interest of reader’s time and not dunking too hard on the uninformed, I’ve pulled it. Readers will have to take my word that the theories are as stupid as I claim, though the director’s cut version is available to anyone brave and/or insane enough to ask for it.

The employees at the market-makers, hedge funds, brokerages, clearinghouses, and regulatory agencies, financial reporters, etc. etc.

We argued in our first very post that the market's insane response to the merger between Churchill Capital IV and Lucid Motors LCID 0.00%↑, announced on Feb. 23, marked the true end of that rally.

Blink Charging executed this the best (or worst, depending on your point of view). On Feb. 1, they announced they had retained Shareintel for an investigation into “suspected illegal naked shorting activity”. Five days later, the company announced a $75 million equity offering (almost 10% dilution). BLNK is down by nearly half since then, so the long-term effects may not necessarily hold.