L.B. Foster: A Messy, Hidden, Attractive Opportunity

A closer look at FSTR shows a strong valuation, secular tailwinds, and a decent chance to double (or more).

📍 TLDR:

At more than 11x trailing twelve-month Adjusted EBITDA, and with a leveraged balance sheet, FSTR at first glance looks like an easy sell.

But after five acquisitions and divestitures in a 12-month span, headline numbers here don’t tell the entire story.

Valuation in fact is quite reasonable, while federal government spending suggests a tailwind in 2023 and beyond.

Mid-term targets suggest enormous upside, though they don’t need to be hit for shareholders to win.

Small- and micro-cap stocks should provide opportunities that some market participants do not or cannot take advantage of. ‘Messy’ corporate stories can provide a similar potential catalyst: that the earnings power and value of the underlying business are masked by headline fundamentals that don’t capture either.

The hope for L.B. Foster FSTR 0.00%↑ is that FSTR stock can provide both. FSTR has a story that is better than the headlines suggest, while its small-cap nature keeps that story from being discovered by the market — for now.

Introducing L.B. Foster

Founded at the beginning of the 20th century, L.B. Foster has long been a supplier to the railroad industry. That business, now operating as the Rail, Technologies and Services segment (RTS), provides everything from actual rail to fasteners, plates, friction management products, digital signage and monitoring systems.

In its Precast Concrete segment, L.B. Foster’s legacy business produces precast buildings, primarily for national, state, and local parks (think restrooms, concession stands, and the like). A recent acquisition expands the company’s reach here (more on this in a moment). The Steel Products and Measurement segment includes the manufacture of steel grid decking for bridges, aluminum bridge railings, along with pipe threading services, pipe coatings, and metering and injection systems for oil and gas.

In 2021, 58% of revenue came from the RTS segment; 14% from Precast Concrete; and 28% from Steel Products and Measurement. Year-to-date, that proportion has changed somewhat, to 62%, 19% and 19%, respectively. It will change again going forward, as L.B. Foster is not quite the same business it was at the beginning of the year.

What FSTR Looks Like Now (Not Much)

From a high-level perspective, after November’s third quarter earnings report, FSTR stock admittedly looks pretty ‘meh’, as the kids say. A simple review of the Q3 earnings release shows the extent of corporate activity, with two acquisitions and two divestitures mentioned in the first paragraph, along with “nonroutine items”. But, fundamentally, that activity doesn’t seem to have created much of an opportunity.

Year-to-date GAAP net income is negative $1.6 million, against $4 million in the same period during 2021. YTD free cash flow is much worse: L.B. Foster has burned $23 million, more than 20% of its current market capitalization.

The balance sheet is net leveraged 5.7x, while EV/EBITDA is over 11x1. Trailing twelve-month Adjusted EBITDA is down 12% against the prior four quarters, and there is some obvious cyclical exposure ahead as well.

If anything, this looks like a potential short. The relatively low volume and low market cap probably preclude that kind of trade; indeed short interest here is tiny (totaling $220,000 or so at the moment). But the low short interest seems driven by structural factors rather than fundamental ones: simply looking at the numbers, FSTR on its face appears to be a pretty easy sell.

A Changing Business

But what is important to remember about FSTR coming out of third quarter results is that the business has seen a number of changes over the past year-plus. In September 2021, Foster sold its Piling Products division for $24 million.

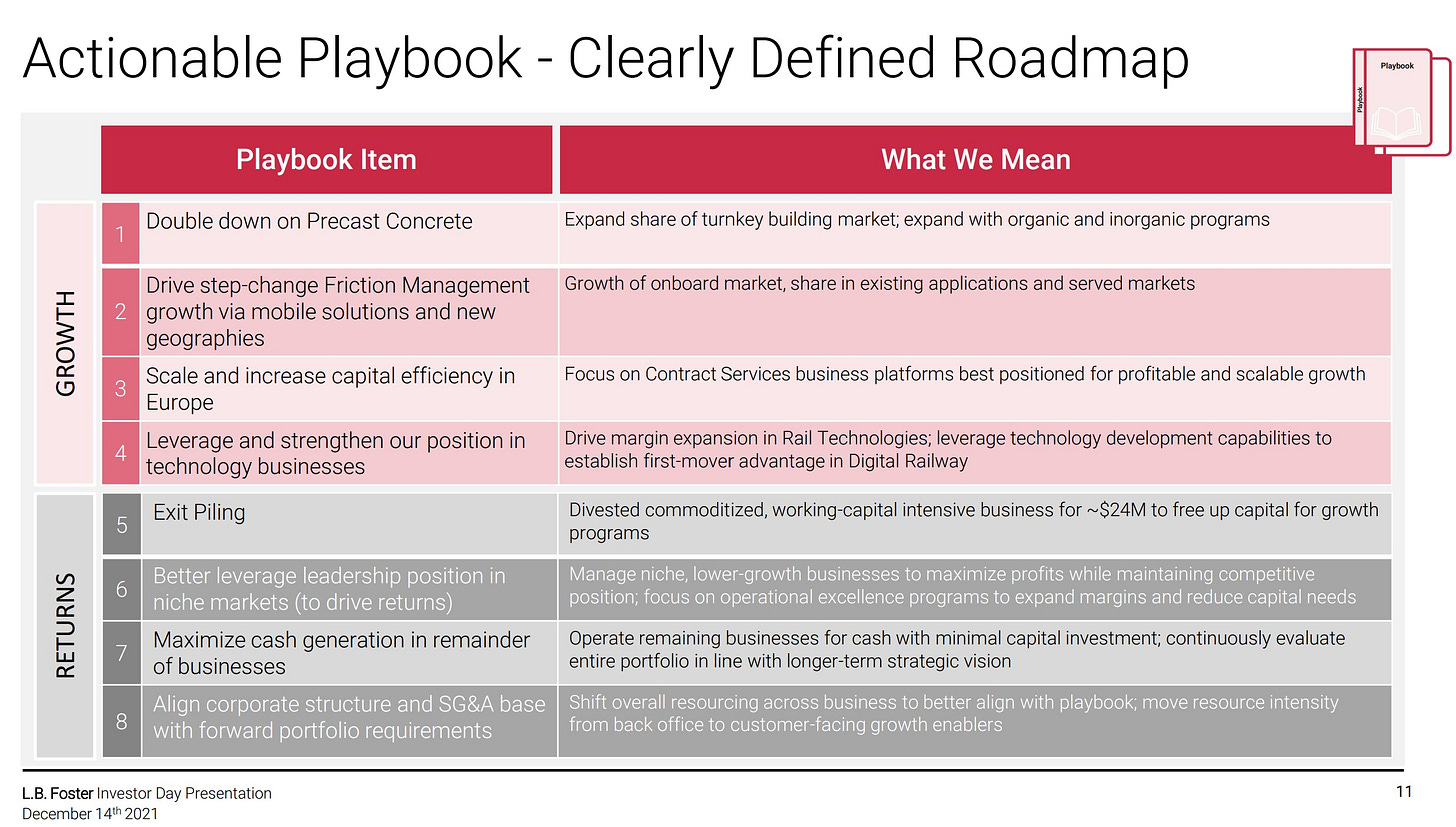

The sale was the first step in a strategy detailed at an Investor Day presentation three months later:

source: L.B. Foster Investor Day presentation, December 2021

In June, Foster acquired the U.K.’s Skratch Enterprises, a manufacturer of digital signage, for $7.4 million. The following month, it further boosted its presence in the country with a smaller purchase of Intelligent Video, a subcontractor for its remote monitoring business. Both deals added to the company’s technological capabilities, while also providing a beachhead for further growth in Europe.

Then in August, Foster exited another business (and, like the piling operation, a commoditized business) by selling its rail spikes and anchors business, headquartered in Canada, for almost $8 million. Two weeks later came the big acquisition: precast concrete manufacturer VanHooseCo for $52.2 million.

Obviously, the company saw quite a bit of movement in twelve months, but there is a coherence to the five transactions. L.B. Foster is trying to get out of capital-intensive, commoditized businesses and become more capital-light and technologically advanced. Even VanHooseCo, by the standards of its industry, has some intriguing innovations, including above-grade concrete walls for residential applications.

We’ve written this before, and we’ll no doubt write it again: M&A always looks attractive on a PowerPoint slide. But there are some deals and some ‘transformation’ strategies that look questionable on their face. Here at least, the playbook has logic behind it: L.B. Foster management is trying to create a better, faster-growing, higher-margin business.

The Fundamental Case

To what extent that strategy will work is not yet clear. But it’s worth noting that, right now, FSTR’s fundamentals are not reflective of the overhauled business.

Again, FSTR is trading at about 11x Adjusted EBITDA on an enterprise basis. But that enterprise value includes the full value of the debt backing the VanHooseCo acquisition — while Adjusted EBITDA only includes about seven weeks of operating results from that acquired business.

In other words, L.B. Foster’s reported Adjusted EBITDA is not its pro forma Adjusted EBITDA. We can get a sense of the latter figure from a December presentation [pdf] at a Singular Research conference, in which L.B. Foster disclosed its lender-calculated gross leverage ratio. That ratio, as of Q3 2022, suggests trailing twelve-month EBITDA not of ~$20 million, but of ~$30 million.

The calculations of the reported figure, and that defined by the debt agreement, are not perfectly aligned. Reported Adjusted EBITDA adds back a $4 million contract cancellation charge in Q3 (which reduced revenue and gross profit); the lender-calculated figure does not. But the latter includes $3.9 million in “business transformation expenses”, a line item near a 15% cap in the debt agreement, and one that does not appear to be backed out of Adjusted EBITDA as defined in the earnings release.

Net/net, however, the ~$30 million figure seems reasonably close to backwards-looking earnings power. The non-GAAP reconciliation (slide 30) cites $10.4 million in pre-acquisition EBITDA from purchased businesses. The debt agreement-based EBITDA amount also includes some profit from the anchors and spikes business divested this year, but probably ~$1 million or so (the presentation elsewhere cites annual profit in that business of about $1.5 million).

We can call pro forma EBITDA likely $29 million or so — and there, the fundamentals here start to look notably more attractive. EV/EBITDA now dips below 8x. Cash flow normalized for taxes and working capital looks to be in the $14 million range2, suggesting a P/FCF multiple also around the 8x level.

Understanding the Cycle

On their own, those multiples aren’t enough, particularly in this market. This is a low-margin business: even using the more generous lender calculation, EBITDA margins are in the 6% range. And it’s a leveraged business: still ~4x EBITDA when using the more generous calculation and including $20 million owed to Union Pacific UNP 0.00%↑ as part of a warranty claim settlement3. On a multi-year basis, this looks like a business in decline: 2019 Adjusted EBITDA was $45.6 million.

In that context, then, 8x EBITDA and 8x free cash flow are maybe attractive, and maybe just appropriate. Peer comparisons don’t really exist here, and so the valuation here to some extent is in the eye of the beholder. But at the very least, neither 8x multiple suggests this business is a screaming buy.

But, here too, investors need to look a little bit closer. This is a cyclical business, yes. But what makes FSTR intriguing is that (for several reasons) the company appears closer to the bottom of the cycle than the top.

First, like essentially every U.S. business, Foster has been managing through a time of cost inflation, supply chain issues, and labor pressure. Most notably, the legacy precast concrete business signed contracts in 2021 at prices fit for that year — and then delivered those projects with 2022 costs.

The impact of that issue was clear in the most recent results. In Q1, gross margins declined 160 bps year-over-year excluding the divested Piling business. In Q2, the figure compressed 50 bps on the same basis. Then in Q3, excluding the contract settlement and purchase accounting related to VanHooseCo, gross margins expanded 370 basis points. The acquisition helped, but as management detailed after Q3, normalized pricing was a major factor. That pricing is set to benefit coming quarters, boosting margins and profits in the near term.

Taking the multi-year view, one key problem has been the company’s coatings and measurement business. Those businesses get more than 80% of revenue, per the Q1 2021 call, from midstream oil and gas customers. And with pipeline development in the U.S. essentially brought to a halt, C&M has been crushed.

In 2021, Foster’s Adjusted EBITDA declined $13.3 million, of which $11.8 million came from coatings and measurement. After Q1 2021, then-chief executive officer Bob Bauer said the business, in its salad days, had been doing $20-$30 million in orders per quarter. Figures from the 2021 10-K imply the business generated about $28 million in revenue for the entire year.

Between C&M and the cost/pricing imbalance, the negative multi-year profit trajectory here is completely explainable. More importantly, C&M provides upside optionality going forward. Management has said repeatedly in recent quarters that it doesn’t see a major upswing on the way, but at some point pipeline infrastructure will need to be rebuilt.

In the meantime, a win on a major carbon sequestration pipeline suggests as much as $20 million in revenue, though that project still faces challenges in getting across the finish line. And when C&M does swing back, the impact to EBITDA can be significant: The significant profit loss from C&M weakness in 2022 suggests that the business is perhaps the highest-margin unit in Foster’s portfolio.

Government Spending Ramps

Finally, there’s the impact of U.S. federal government infrastructure spending. Here’s how current CEO John Kasel put it on the Q1 conference call:

Our business has benefited from significant government funding of infrastructure projects in the past. And the funding levels approved over the last two years are greater than we have ever seen before.

And here’s commentary on the same front following Q3:

We do, however, have line of sight to significant infrastructure projects across the portfolio that are well aligned to our growth strategy and quotation activity is increasing. We believe these programs will provide some degree of demand support should market conditions deteriorate.

The Great American Outdoors Act, passed in 2020, has already helped the legacy precast concrete business. The infrastructure bill signed in late 2021 has the potential for much, much more, boosting park spending, bridge repair, and other key end markets for L.B. Foster.

The boost from that bill hasn’t arrived yet, though management expects it will start in 2023. It’s not a one- or two-year tailwind, either. American infrastructure requires significant investment, to the point that infrastructure spending was one of the few policy priorities (and maybe the only policy priority) shared by both the Trump and Biden Administrations.

Obviously, a recession could pressure construction-exposed revenues elsewhere, a risk Kasel alluded to in his commentary on the Q3 call. But net/net, the external environment in 2022 appears negative for L.B. Foster, not positive, yet FSTR clearly is priced as if the reverse is closer to the truth.

Valuation and Long-Term Reward

What’s attractive about FSTR, then, is that an investor doesn’t have to fully believe in the business transformation story to see the stock as a buy. It’d be great if the move into tech and the added scale in precast concrete and the European businesses indeed helped growth and margins. But strategic success absolutely is not a requirement for solid upside from the current price above $10.

Revenue growth, delevering, and fixed-cost leverage alone get the job done. Q4 on its own will help the balance sheet. Inventories have built by more than $22 million year-to-date. That working capital headwind should reverse somewhat in Q4, which chief financial officer Bill Thalman after Q3 predicted would be “a strong cashflow quarter”.

Looking out, say, five quarters, there’s room for net debt (including payments to Union Pacific) to decline by at least $20 million, even assuming inventory build. Hold EV steady and that alone suggests almost 20% upside in FSTR stock to ~$12. Revenue growth and/or margin expansion (which given the model here should go together) can amplify those gains.

Longer-term, L.B. Foster continues to target $50 million in 2025 Adjusted EBITDA, a goal it set toward the end of 2021. That figure does require success in the transformation strategy as well as some acquisitions (the company sees ~$150 million in acquired revenue and consolidated EBITDA margins of ~8%), but assuming free cash flow goes to those acquisitions, and the UNP liability is extinguished, a conservative ~8x multiple suggests a path for FSTR to nearly triple to ~$30 or so4.

Right now, then, this looks like it should be a stock trading in the mid-teens. The base assumption has to be for growth, off the pro forma base, in both 2023 and 2024. That growth comes from both acquisitions rolling into the TTM reported figure and revenue increases boosting profit. Even in a bear(ish) market, 7.5x $33 million in EBITDA less net debt of $85 million (thanks to inventory conversion and 2023 free cash flow) gets the stock to $14. Between strategic changes, government help, and the possibility of improved broad market sentiment, there’s clearly optionality to the upside next year and beyond.

The Risks, Or Why This Time Should Be Different

So what goes wrong? Readers who are familiar with Foster’s history admittedly might be exceptionally skeptical of this story for one core reason: we’ve been here before, and it didn’t go well.

That’s actually understating it: it was an absolute disaster.

In late 2014, Foster decided to move aggressively into the oil and gas space. It acquired Chemtec Energy Services for $67 million; in March of the following year, it acquired Inspection Oilfield Services for $167 million.

To put those deals into context, right now Foster has an enterprise value of $226 million (including the UNP liability), less than the combined price of those two acquisitions. The problem was simple: Foster entered the upstream business right as the shale bust was occurring. Incredibly, it took a goodwill writedown in Q3 2015, months after the acquisitions were made. In September 2020, it sold IOS for $4 million, 97% less than it had paid.

FSTR traded near $50 before those acquisitions; it’s now barely at $10. Management didn’t blow up the company with those deals, necessarily, but it blew up the stock.

The risk here is that to some degree history repeats. The VanHooseCo deal too is moving into the cyclical construction business at perhaps the wrong time (though we’re not yet convinced that is the case). A balance sheet that was barely 1x leveraged before the pandemic has been weighed down with debt.

The risk is real, but seems manageable. Kasel hopefully has learned from the errors of his predecessor5. Most notably, the story here can hold up without VanHoose, which generated ~$7M in EBITDA in 2021. Move that figure to zero and, pro forma, FSTR still is at a single-digit EV/EBITDA multiple, still has positive free cash flow, and still has cyclical tailwinds elsewhere on the way elsewhere in the business. With VanHoose (based in Tennessee) largely targeting the southern U.S., where construction trends are likely to stay stronger, the downside case may not be quite so severe.

And, at the least, the rewards here seem worth the risk. The worst-case scenario is worth considering, but what seems more important is that the best-case scenario doesn’t have to play out for FSTR to rally 100%-plus.

As of this writing, Vince Martin has no positions in any securities mentioned.

If you enjoyed this post please do us a huge favor and hit the heart button! ❤️

Disclaimer: The information in this newsletter is not and should not be construed as investment advice. Overlooked Alpha is for information, entertainment purposes only. Contributors are not registered financial advisors and do not purport to tell or recommend which securities customers should buy or sell for themselves. We strive to provide accurate analysis but mistakes and errors do occur. No warranty is made to the accuracy, completeness or correctness of the information provided. The information in the publication may become outdated and there is no obligation to update any such information. Past performance is not a guide to future performance, future returns are not guaranteed, and a loss of original capital may occur. Contributors may hold or acquire securities covered in this publication, and may purchase or sell such securities at any time, including security positions that are inconsistent or contrary to positions mentioned in this publication, all without prior notice to any of the subscribers to this publication. Investors should make their own decisions regarding the prospects of any company discussed herein based on such investors’ own review of publicly available information and should not rely on the information contained herein.

Fully-diluted market cap is $112.4 million, and net debt $94.0 million. Foster also owes $20 million as part of a warranty claim settlement, to be paid in quarterly installments. Treating that settlement as debt, with trailing twelve-month Adjusted EBITDA of $19.9 million, net debt is 5.7x and EV/EBITDA 11.3x.

EBITDA is $29 million, cash interest is $7M with room to come down, D&A $14 million, tax rate 21% (call it $2M cash), capex $6M.

In 2019, the two companies settled the warranty claim relating to concrete ties installed on Union Pacific tracks. L.B. Foster agreed to pay $50 million over six years; Union Pacific agreed to purchase $48 million in product. $20 million remains of Foster’s obligation.

Foster has said it’s targeting a 2x net leverage ratio; at $50 million in EBITDA, the company could keep the same ~$94 million net debt balance it currently holds.

Kasel was with Foster at the time — he joined the company in 2003 — but as a senior vice president with the rail division, he likely had little if any involvement in the strategic decision to go big into upstream O&G.

How on Earth did you find FSTR? Through insider buying? I'm ordering a concrete turret for my rental:

https://www.vanhooseco.com/custom-projects/

Hi quick question, if you had to put a number (1-10 , ten being highest probability of bankruptcy)

What would you say is the likely hood of $FSTR going bankrupt if we enter recession because of debt and negative FCF?

Given the debt levels and my experience with companies promising “rosy” outcomes so far none have been able to execute as promised but at least (in my case) both generating significant cash flow