Nathan's Famous: A Much Better Business Than You Think

A hot dog company at 14x trailing EPS doesn't sound like an attractive proposition. But it is.

April was a brutal month for equities. The NASDAQ Composite dropped 12%, the Russell 2000 10%, and the S&P 500 7%. Both the small-cap Russell 2000 and the large-cap NASDAQ 100 are firmly in bear market territory (-24% and -23% from their highs, respectively). For many investors, ourselves included, the declines ‘feel’ worse, given the overall results include pockets of strength in a few sectors (notably energy and consumer staples).

And yet, at least anecdotally, there don’t appear to be a ton of stocks that have been oversold simply because of rising nervousness in the broad market. So many names look cheaper, perhaps, but still far from cheap on an absolute basis. Examples abound in the mega-cap space, certainly; the likes of Tesla (TSLA), Netflix (NFLX) and even Amazon.com (AMZN) (the latter of which we rather like) don’t seem like screaming buys even after relatively steep sell-offs.

Indeed, we wrote in our very first post that we didn’t think the market was at a bottom; that prediction has been correct, even if our strategy following it has not quite been. It still seems like the declines to this point are driven far more by equities being overvalued at the highs, rather than undervalued now. This is not yet the second half of 2009 (when the problem, quite literally, was sifting through all of the opportunities), nor does it yet seem like March-April 2020.

Still, from a long-term perspective this sell-off will create some huge winners. And from a short-term perspective, we are starting to see some names that are simply getting dragged down by sentiment, even though the underlying fundamentals haven’t changed at all. We highlight one of those names here.

source: Nathan’s Famous

Introducing Nathan’s Famous

Nearly all American readers — and some international investors — will know Nathan’s Famous well. For over a century, the company has operated hot dog stands across the country, beginning with its flagship location in Coney Island in New York City.

In recent decades, however, Nathan’s Famous has evolved into a licensing company rather than a restaurant operator and franchisor. The lion’s share of operating profit comes from an agreement with John Morrell & Co., a subsidiary of Smithfield Foods (itself a unit of WH Group (WHGLY)). In fiscal 2021 (ending March), licensing profit accounted for the lion’s share of overall earnings. Over 90% of licensing revenue came from the Morrell deal.

Nathan’s does have other profit streams. Its Branded Product Program sells to distributors who in turn serve quick-service chains (pretzel company Auntie Anne’s, burger restaurant Johnny Rockets, Hot Dog on a Stick), movie theaters, theme parks, and stadiums and arenas. The restaurant business is down to four wholly-owned locations, along with 213 franchised restaurants; NATH owns both its namesake IP as well as fish and chips brand Arthur Treacher’s.

But, again, it’s the core licensing agreement with Morrell that really is the engine here. And it’s an attractive agreement. Nathan gets a 10.8% royalty on revenue. The deal doesn’t expire for another decade. Margins are enormous; even backing out all of the company’s corporate expense, more than 75 cents of each dollar in licensing revenue turns into operating profit. And it doesn’t look like that agreement is priced in — at all.

NATH Stock Sells Off

source: finviz.com

Save for a brief dip during the March 2020 pandemic-driven sell-off, NATH trades at a five-year low. That includes a ~13% decline over the past month — on literally no news. During that period, Nathan’s Famous has not issued a press release or made a filing with the SEC.

In terms of both the short-term and long-term declines, the obvious question is why the stock has sold off. And there are some valid reasons. The 2018 peak at $100-plus probably was a bit too much (indeed, we looked closely at the stock into and out of that peak and passed). The coronavirus pandemic hit both BPP, as arenas, movie theaters and theme parks closed, and obviously the company’s restaurant business.

It ostensibly also boosted the licensing business. As Nathan’s Famous itself wrote in the FY21 10-K:

During the fiscal 2021 period, royalties from our license agreements were significantly higher than during the fiscal 2020 period, due to significantly higher sales of consumer-packaged goods through grocery channels as consumers elected to “shelter at home” as a result of the COVID-19 pandemic.

And, again, the licensing business is the key engine here. A return to normalcy will help the BPP and restaurant segments, but those gains potentially would be offset by pressure on supermarket sales via Morrell.

Meanwhile, inflation seems a potential issue, and that bogeyman may be in part driving the sell-off of the past few weeks. Recession fears can pressure sentiment toward the BPP business, in particular. Of course, there are potential long-term worries as well. Hot dog consumption appears to have beein in decline even before the pandemic. The product is not particularly healthy, and there are environmental worries as well.

But none of these explanations seem particularly satisfactory, particularly relative to the decline of the past few weeks. Inflation concerns didn’t just pop up in late March — and are not a problem for the licensing business, where the costs are Morrell’s problem. And anyone who’s spent any time in New York City knows that recessions are good for hot dog sales:

source: Gothamist.com

In all seriousness, Nathan’s should be able to ride out a recession. Indeed, it’s already done so: from FY08 to FY10, the business held up just fine. Lower out-of-home spending would hit BPP, but there’s the trade-down possibilities for franchised restaurants, as well as potential strength in supermarket sales.

Nor is there anything in the company’s results in the first three quarters of FY22 to suggest weakness. NATH stock actually rallied 8%-plus after Q3 earnings were released in early February. YTD, revenue is up 57%; Adjusted EBITDA 16%; and earnings per share 27%. Importantly, the Licensing business has barely moved: against pandemic-driven comps, YTD revenue is down less than 2%.

Taking the long view, the pullback from $100 perhaps makes some sense. But getting to the current $47, particularly with a double-digit decline in recent weeks, simply doesn’t. The risks here generally net out. A return to normalcy does perhaps hit Licensing in future quarters, but will also continue the rebound in BPP revenue and profits. Inflation ostensibly hits the restaurant business, and maybe sales elsewhere if beef continues to be an outlier, but lower volume in Licensing and higher prices still suggests some resilience to the core profit stream from Morrell.

It seems equally likely, if not more likely, that in the short-term a thinly-traded1 stock simply has taken a hit due to market weakness, and maybe a bit of ETF selling2. And from a broader perspective, perhaps one problem is that the business doesn’t appear all that attractive.

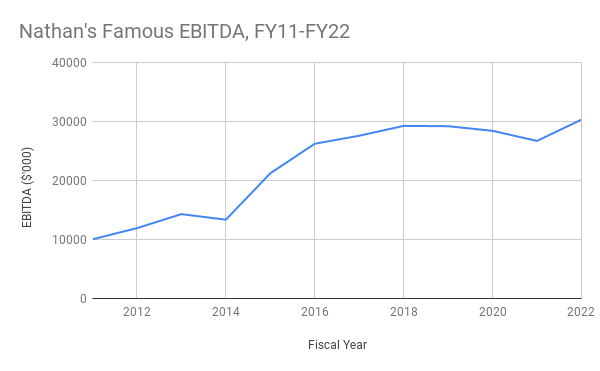

Overall profits really haven’t moved since FY16 (Adjusted EBITDA that year was $27.2 million; the figure on a trailing twelve-month basis is about $31 million). A 14x+ P/E multiple for a “hot dog company” doesn’t scream value in a screen. But if you look closer, there’s an attractive case here that likely will get more attractive soon.

Interest Savings Boost The Fundamentals

Back in 2015, Nathan’s Famous issued $135 million in debt. It then took those funds and paid out a $25/share special dividend, a total distribution of about $116 million.

On its face, the move made some sense. Nathan’s had just signed the Morrell deal, an 18-year agreement with rising fixed minimum payments. Management (including chairman Howard Lorber, who owned and still owned 20%-plus of the company) no doubt saw an opportunity to leverage up against that deal in the recapitalization.

The problem was that Nathan’s wound up getting an interest rate of 10 percent3. The $13.5 million in annual interest payments ate up a full 60% of the $22.5 million in FY15 Adjusted EBITDA. On that news, NATH stock unsurprisingly fell sharply.

Two years later, Nathan’s managed to refinance, getting the rate down to 6.625%. And starting in November, those bonds are callable at par. In January, Nathan redeemed $40 million, which will save $2.65 million in annual interest expense going forward. With ~$44 million in cash on the balance sheet at Dec. 31 (pro forma for that redemption), there’s room to call more bonds and save another $1-$2M annually, particularly with a likely $10M+ in free cash flow coming during calendar 2022.

So let’s look at NATH on a consolidated basis. TTM EBITDA4 is $30.3 million. Updated interest expense is $7.3 million; D&A about $1.3 million and capex <$1M; shares outstanding were 4.115 million at Feb. 4. The effective tax rate has generally been in the 27% range5.

So, pro forma for the bond redemption, net income should be $15.8 million, leading to EPS of $3.85. Free cash flow per share should near $4.

At $47, then, this is a business priced at ~12x FCF — or, essentially, zero growth.

Nathan’s Grows, NATH Wins

So the bet here is that a stock that:

has had a double-digit, no-news sell-off in recent weeks;

has an financially-experienced (Lorber is also the CEO of holding company Vector Group (VGR)) management team that owns almost one-third of the company;

has some room for financial engineering, including a version of the 2015 recap (albeit one that is timed and priced better);

has an attractive licensing deal that accounts for ~80% of YTD segment-level profit;

and hasn’t seen a full rebound in its two smaller profit streams;

will grow earnings — at all. Even flattish EBITDA/FCF performance probably drives some kind of positive return; investors get a 3.8% dividend yield in the process and some optionality on new efforts / further interest reductions / a sale of the company. (More on these in a moment.)

Obviously, the key risk here is to the Morrell profit stream. And the risk to supermarket sales are legion. Kraft (KHC) took a $626 million impairment charge on its Oscar Mayer brand in 2020. Morrell itself offers pork/chicken dogs under its namesake brand as well as Farmer John’s (until last year, the supplier of the well-known “Dodger Dog” for Major League Baseball’s Los Angeles Dodgers). If beef price inflation outpaces other meats, Morrell ostensibly could pivot toward pushing those cheaper options — or consumers could make that decision on their own.

The steady growth in Licensing revenue, from $18 million in FY15 to ~$30 million-plus this year, also has been driven by door count. Packaged Nathan’s were available in 39,000 supermarkets, club stores, etc. at the end of FY15, per that year’s 10-K. The figure rose to 63,000 four years later, and was 79K at the end of FY21 (though that was a worldwide which included foodservice points of sale).

Ostensibly, door count growth is at an end; there are ~63,000 grocery stores in the U.S., total. Over the four-year stretch from FY15 to FY19, licensing revenue per door went from ~$462 to ~$375; even assuming incremental locations were lower value-add, there’s little organic growth in there, and potentially a decline. (That’s true in terms of volume as well; pricing appears to have declined over that period, but modestly so.)

But bear in mind that Nathan’s, over the first three quarters of FY22, posted just a 1.4% decrease in volume against an enormously difficult compare: volume rose 21% in the first three quarters of FY21. In Q3, per the 10-Q, licensed product volume did decline 11% year-over-year — which seems like a potential concern. But that decline comes against a 40% increase the quarter before, and even in Q3 FY22, prices rose 14%, leading Licensing revenue to stay flat.

There are challenges looking forward, certainly, and price (and thus royalty) inflation may be offset by price-elastic volume declines. Still, even at FY19 segment EBIT (~$23 million), with all else equal, NATH is trading at ~10x EBITDA and ~16x free cash flow. That requires a ~25% drop in Licensing revenue — yet there’s no real evidence of any material decline yet.

There are some risks to BPP profits from cost inflation. Operating margins in the segment in the first three quarters of FY22 were 9.8%, against 13.6% over the same period two years earlier. Hot dog costs — up 14% year-over-year YTD — are the key driver there. But, again, we’re operating off trailing twelve-month figures, which don’t include any response from Nathan’s Famous to the soaring cost inflation. And there are still some venues which during the first half of FY22, in particular, were not operating at full capacity. Bear in mind that BPP had expanded nicely before the pandemic, with segment EBITDA rising 117% between FY15 and FY19.

A similar sense holds in the restaurant business. Franchise fees and royalties are still down 17% against 9M FY20. Operating income is off $1.6 million. As with the licensing business, cost issues are largely someone else’s problems. Obviously, over the long term inflation can be a problem if franchisees really start to struggle, but there’s room for some kind of reversion to the mean for Nathan’s profits in the segment. The longer-term trend there admittedly has been more negative, but at ~$1M in trailing EBITDA either the business gets better or (presumably) significant changes follow.

Again, all that needs to happen for upside here is for Nathan’s Famous to grow from here. And even after two years in which each of the three segments has taken a reasonable hit at some point, the business has grown nicely over time:

source: author

The core business should remain relatively defensive, and BPP and the restaurant operations have room for a rebound. Operationally, NATH looks too cheap — and there are some levers to pull here as well.

Levers To Pull

As far as the business goes, the long-term trend still seems positive — and that should be enough to allow NATH to rebound as the equity market settles and business conditions normalize. But there are factors that can amplify that upside as well.

Operationally, one intriguing opportunity for the business is “ghost kitchens,” or delivery-only restaurants. As of August, Nathan’s Famous had 220 such locations, and the company has even launched a virtual brand, Wings of New York. To what extent ghost kitchens can really move the needle even against a ~$200M market cap is unclear, but the effort is a low-cost shot on goal that can perhaps drive much-needed growth on the restaurant side of the business.

Financially, again, the remaining long-term debt will be callable starting in November. And while the 2015 recap was done poorly — and tanked NATH stock in the process — the strategy was actually logical. Indeed, the stock ~doubled from the 2015 decision (even though shares fell 40% afterward) to 2019 highs. Nathan’s will have some flexibility to execute more financial engineering if desired. (A rising-rate environment admittedly adds some difficulty, but the current debt still yields less than 6%.)

There’s also the possibility that the endgame here winds up being a sale. A strategic acquirer is somewhat difficult to imagine, admittedly. A packaged foods player like Hormel (HRL) would want to bring production in-house, but wouldn’t be able to do so for a decade; Smithfield probably has little interest getting into the restaurant business.

But a balance sheet now net leveraged at barely 2x EBITDA does open the door to private equity at some point. Lorber is 73, and the institutional investors presumably wouldn’t mind cashing out at a premium, particularly if the stock can rebound as 2022 goes on.

These catalysts admittedly aren’t immediate — even further debt reduction likely doesn’t happen until the end of the year, if it happens at all. And so, as has been the case for the the past few weeks, caution and patience are advised.

Still, this is a stock that’s fallen off the table of late for no apparent reason beyond market weakness. Yet the core driver here really shouldn’t be impacted much, if at all, by the factors driving that weakness. NATH wasn’t an overvalued tech stock; rather, it’s a defensive play. When investors stop selling indiscriminately, and start buying surgically, the stock is a strong candidate for a quick rebound.

Disclosure: As of this writing, Vince Martin has no positions in any securities mentioned. He may initiate a long position in NATH this week.

Disclaimer: The information in this newsletter is not and should not be construed as investment advice. Overlooked Alpha is for information, entertainment purposes only. Contributors are not registered financial advisors and do not purport to tell or recommend which securities customers should buy or sell for themselves. We strive to provide accurate analysis but mistakes and errors do occur. No warranty is made to the accuracy, completeness or correctness of the information provided. The information in the publication may become outdated and there is no obligation to update any such information. Past performance is not a guide to future performance, future returns are not guaranteed, and a loss of original capital may occur. Contributors may hold or acquire securities covered in this publication, and may purchase or sell such securities at any time, including security positions that are inconsistent or contrary to positions mentioned in this publication, all without prior notice to any of the subscribers to this publication. Investors should make their own decisions regarding the prospects of any company discussed herein based on such investors’ own review of publicly available information and should not rely on the information contained herein.

Finviz.com reports the float at 2.8 million shares against 4.1M+ outstanding, but that probably overstates the case. At July 20 of last year, insiders owned 31%, and there’s been one insider trade since (for 113 shares). Four institutions held a roughly equal amount, and don’t seem to have moved much (major shareholder GAMCO appears to have modestly increased its stake). We’re realistically looking at ~1.6M shares available for trade.

Admittedly, ETF selling probably isn’t a huge factor. According to ETF.com, ETFs only hold about 173K shares. The iShares Russell 2000 ETF (IWM) accounts for more than one-third of the total, and since 3/31 its ownership of NATH has dropped by only 1,140 shares, or less than 10% of the stock’s 30-day average daily volume.

A Value Investors Club article not long after claimed that management expected a lower borrowing rate, but didn’t want to pull the deal at the last minute once the debt priced.

My calculations are slightly different from those of NATH, who somewhat oddly include interest and other income, along with a modest amount of share-based comp, in their Adjusted EBITDA figure. I’ve historically used GAAP EBIT plus D&A plus/minus non-cash adjustments, of which there are none in the past four quarters.

Interest reduction should lower that rate modestly as well, as current annual interest payments totaling just shy of $10M appear to exceed the 30% of EBITDA cap on deductions.