Highlights:

Manufacturers of outdoor recreation products have been hit hard by a cyclical turn in recent quarters, with boat manufacturers the highest-profile losers.

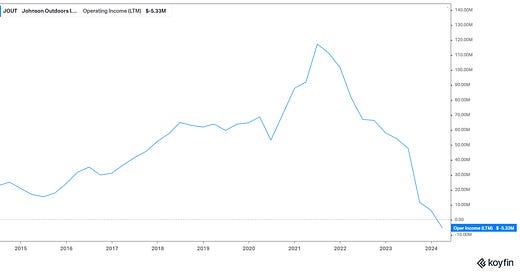

This manufacturer has seen similar pressure: revenue dropped 11% in its fiscal 2023 and another 17% in the first half of FY24.

Taking the long view, valuation looks attractive. A current EV/EBITDA multiple of 13x is near a trough, and shares trade at a discount to tangible book value.

Timing and catalyst are clear concerns, but the name has a strong “buy it now and leave it alone for three years” type of case. Upside should arrive once the cycle turns again.