Research Notes: Macy's And Mulberry

A U.S. giant gets an offer, while a U.K. luxury play looks to get its house in order

Highlights:

Macy’s has received a buyout offer at $21 per share, which has led to a 15% rally in the stock over the past five sessions.

But third parties have been taking a run at the retailer for nearly a decade; those efforts haven’t created any shareholder value.

Gains in sympathy from JWN and KSS seem particularly foolish.

We pivot overseas to look at Mulberry, whose long-running turnaround efforts seem to come down to one simple question.

This week, we’ll take a look at a pair of stories in the retail space: one of the best-known retailers in the U.S., and what used to be one of the premier brands in the U.K. Both offer potential external catalysts (one has already received a takeover offer). But the history of both companies suggests some caution.

Remembering Ruby Tuesday

During the 2010s, there was a deep value thesis for shares of restaurant operator Ruby Tuesday. Relative to earnings, Ruby Tuesday stock didn’t look like much. But the company owned the real estate underlying a substantial number of its restaurants (290 of 750 owned and operated locations heading into calendar 2012) and bulls saw multiple paths for the company to unlock value.

So did the company. In 2012, Ruby Tuesday executed a series of sale-leaseback transactions that brought in upfront cash. That year, RT stock dipped under $8 — and below its tangible book value, a figure that owing to accounting rules understated the actual net value of its assets.

Despite the fact that it looked ‘cheap’ relative to assets, RT stock kept falling for the next six years. All the while, bulls kept arguing that this time the new turnaround strategy would work and that, this time, the gap between the value of Ruby Tuesday’s business in the equity market and the value of its properties in the real estate market was simply too large.

A Value Investors Club article in March 2017, opened by half-jokingly alluding to that long-running bull case: “First posted in 2008, then 2013 and today. Third time is the charm.” In December of that year, Ruby Tuesday was bought out for $2.40 per share, barely one-third of its value at the beginning of 2012. (The company eventually filed for bankruptcy in October 2020, and emerged from Chapter 11 four months later.)

The inherent problem with the real estate-backed thesis was simple: it was predicated on the fact that the real estate would be much more valuable if a different restaurant occupied it. The common shorthand valuation of ~$2 million/location used in real estate-based bull cases required a buyer whose concept could generate a return on that capital. As years of financial performance had proven, Ruby Tuesday was not that concept.

Macy’s Gets An Offer

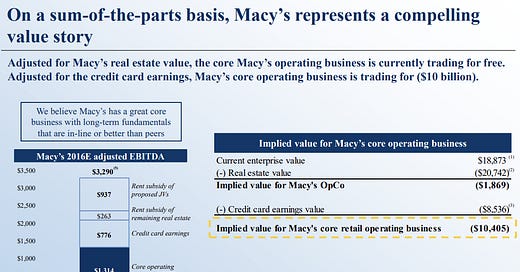

Toward the end of Ruby Tuesday’s time as a public company, some investors saw a similar bull case for a much better-known business. In 2015, well-known activist Starboard Value took a position in Macy’s M 0.00%↑, the iconic1 department store retailer. The firm estimated Macy’s real estate was worth roughly $21 billion. As a result, in a January 2016 presentation, Starboard calculated that Macy’s operating business was being valued at negative $10.4 billion:

source: Starboard Value presentation, January 2016

Macy’s wasn’t completely interested in Starboard’s plans: in November 2015 it said it would not spin off a real estate investment trust to own its properties. But it did take a few steps in that direction. In July 2016, the company hired an investment bank to help it explore ways to monetize its properties. In November, it entered into a partnership with Brookfield Asset Management BAM 0.00%↑. But the process wasn’t fast enough, or big enough, for Starboard. The firm sold its position in May 2017, taking a big loss in the process:

In 2021, another well-known activist, Jana Partners, took a significant stake in the retailer. Jana too was looking to monetize an asset — but, this time, it was Macy’s e-commerce business.

Rival Saks Fifth Avenue was preparing an initial public offering of its digital business, and Jana argued that Macy’s digital business was worth twice the company’s market cap. Macy’s refused to make the move — likely in part because the reception would have been cool; the Saks Digital IPO never happened — and less than a year later Jana had slashed its stake.

Now another firm sees value; in fact, two of them. According to the Wall Street Journal, Arkhouse Management and Brigade Capital have teamed up to offer to buy Macy’s out at $21 per share.