Research Notes: Ozempic Rattles The Market

Investors have reacted quickly to the rise of GLP-1 weight loss drugs. What comes next?

Highlights:

GLP-1 weight loss drugs are moving into the mainstream raising hopes for significant, societal change.

The cultural impact has bled over into the equity markets: Ozempic ‘losers’ are falling, and potential winners beyond GLP-1 manufacturers are gaining sharply.

The importance of “super consumers” means the impact on cash flows and equity valuations can be significant.

In fact, it’s possible the market hasn’t yet reacted enough.

Ozempic and other GLP-1 drugs seem to be taking over the market. In less than three months, Novo Nordisk, the maker of Ozempic and Wegovy (both branded versions of the compound semaglutide), has gained 25%, adding nearly $70 billion in market cap in the process. Eli Lilly LLY 0.00%↑, developer of diabetes drug (and GLP-1 agonist) Mounjaro has rallied 33% since its early August earnings report. Its market cap has increased more than $130 billion. Given flattish performance among other large-cap drugmakers, the three drugs appear to have created roughly $200 billion in incremental equity value.

Of course, the potential of the drugs has done more than boost the share prices of their owners. In the past couple of months, food and beverage manufacturers have sold off sharply, as have alcohol purveyors like Constellation Brands STZ 0.00%↑ and Diageo plc DEO 0.00%↑. Last week, dialysis stocks were crushed after Novo stopped a trial of Ozempic’s ability to treat kidney failure because the trial was clearly set to succeed.

And investors are now looking for second- and even third-order effects. Some have speculated that retailers should do well, since patients on Ozempic will need entire wardrobes of new clothes. On the third quarter conference call of Delta Air Lines DAL 0.00%↑, a Wall Street Journal reporter (perhaps inspired by a note from Jefferies) asked if the company was modeling the impact of Ozempic, which in theory would create lighter passengers and thus lower fuel costs. Delta chief executive officer Ed Bastian replied that his company was not making such forecasts. Jefferies has estimated United Airlines UAL 0.00%↑ could save $80 million a year from less-heavy passengers.

It’s not hard to see echoes of the artificial intelligence/ChatGPT craze from earlier this year. In both cases, a long-awaited trend seems to have arrived — and legitimately altered how investors view hundreds of businesses over the long term.

But it’s worth considering whether the current narrative around Ozempic is correct, in terms of how it is impacting the market right now, and how it will impact consumer behavior in the future.

The Case For GLP-1s

One obvious problem with the AI/GLP-1 comparison is that the reach of GLP-1s should be much smaller. The reach of artificial intelligence over time is close to limitless. The impact of successful obesity drugs will be confined to obese patients with access to those drugs.

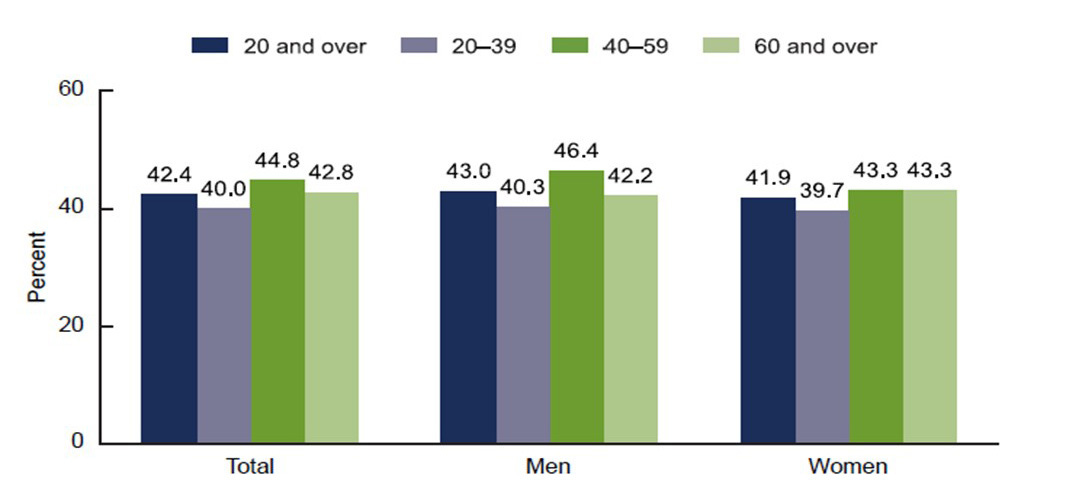

But that narrow market may be bigger than first believed, particularly in the U.S. where over 40% of adults are classified as obese:

source: National Institute of Diabetes and Digestive and Kidney Diseases

More intriguing is the fact that GLP-1s seem to have promise in treating opioid and alcohol disorders as well. We’ve seen anecdotal reports of lower gambling compulsion and even impacts on obsessive compulsive disorder. This month, The Atlantic asked if scientists had “accidentally” created an all-purpose anti-addiction drug.

Just as important as the size of the potential population, however, is the manner of that population’s behaviors. On Twitter, Corry Wang had an excellent thread centered on the importance of super consumers in so many markets. Here are just a few examples from the thread:

9% of adults account for 34% of candy consumption

the top 5% of Canadian gamblers drive 53% (!) of spend

the top 10% of adults consume over 70% of alcoholic beverages

When you consider what that means on the margins for often-leveraged businesses, the loss of super consumers becomes exceptionally important to equity value in a hurry.

For example, Constellation Brands trades at 17x fiscal 2024 operating cash flow of $2.5 billion at the midpoint of guidance. Sales this year should be right at $10 billion.

If Constellation loses 20% of its super consumers, which given the beer-heavy portfolio may only account for 50% of consumption, that’s a 10% hit to sales. Incremental margins here are high: gross profits are modestly above 50%, which includes transportation. So an extra Corona at the bar or case at the supermarket costs the company very little. Assume incremental margins are 70% and now gross profits are falling 7%.

A 7% decline in gross profit means a 28% drop in operating cash flow. It means sharply lower return on invested capital and a potential ceiling on growth. That in turn suggests multiple compression as well, and thus a 30%-plus decline in Constellation stock.

Obviously, this is very much a back-of-the-envelope calculation. Readers will likely disagree with various aspects of the model. But there absolutely is a scenario in which the 20% decline in super consumers is conservative. In that case this model, which presumes at least a 30% decline in Constellation stock, is conservative.

Will Ozempic Change Society?

These drugs are going to be enormously beneficial for the economy, society and public health.

That quote comes from Josh Barro over at Very Serious, part of a long piece in which Barro projects an exceptionally bright future for Ozempic and other GLP-1s. Some of that optimism is based on Barro’s early experience with Wegovy, after a personal history of struggling with weight.

But the optimism is immense. Barro sees GLP-1s — including successor drugs, such as Lilly’s retatrutide, which as Barro notes might be even more effective — as doing much more than improving health outcomes:

Quite possibly, the advance is even broader than that — it may go a long way to address the general problem of people making short-term choices that foreseeably fail to promote their long-term happiness. Isn’t that amazing?

That type of outcome — and there is evidence to support that possibility, even if that evidence is circumstantial — does change the outlook for pretty much every consumer business in the world, and for many of the industrial businesses that supply them. Indeed, Barro projects that GLP-1s will be more transformative than artificial intelligence.

In the comments of the article, however, was a more intriguing comparison: to the launch of the birth control pill. The 1960 approval of Enovid unquestionably changed the world. We can see, at least in outline, a future in which GLP-1s do the same, and, like the pill, have effects that reach further and in more surprising ways than anyone can predict at the moment.

Do We Need To Pump The Brakes?

All that said, it’s fair to wonder if some of the optimism has gone a bit too far.

GLP-1s are not necessarily a magic bullet. Weight loss tends to plateau after 18 months, if not sooner. The loss tends to reverse if a patient stops taking the drug.

And some patients will stop taking the drugs due to side effects, though the severity and prevalence of those effects seems to be somewhat up for debate. One doctor did tell the New York Times that issues like diarrhea and constipation are “no joke”, with patients sometimes winding up in the emergency room. A recent study of adverse events related to semaglutide, however, showed that less than 2% of reports resulted in discontinuation of the drug. It’s worth remembering that GLP-1s themselves aren’t new; the first such drug was approved in 2005, and injectable semaglutide launched in late 2017.

The broader concern seems to be that we’ve been here before. The most notable analogue would be fen-phen, similarly a “miracle drug” for weight loss that was pulled from the market in 1997 after being linked to damaged heart valves. There is a sense, perhaps, that GLP-1s are simply too good to be true: that altering the body’s chemistry has to create deleterious effects somewhere else.

Defensive Staples Go No-Bid

On that latter front, it’s obviously too early to tell. But, overall, the market’s response to Ozempic’s “moment” does seem to have some validity. And the impact of super consumers (in essence, a version of the well-known 80/20 rule) suggests that purveyors of unhealthy food, and perhaps other vices, might be at risk.

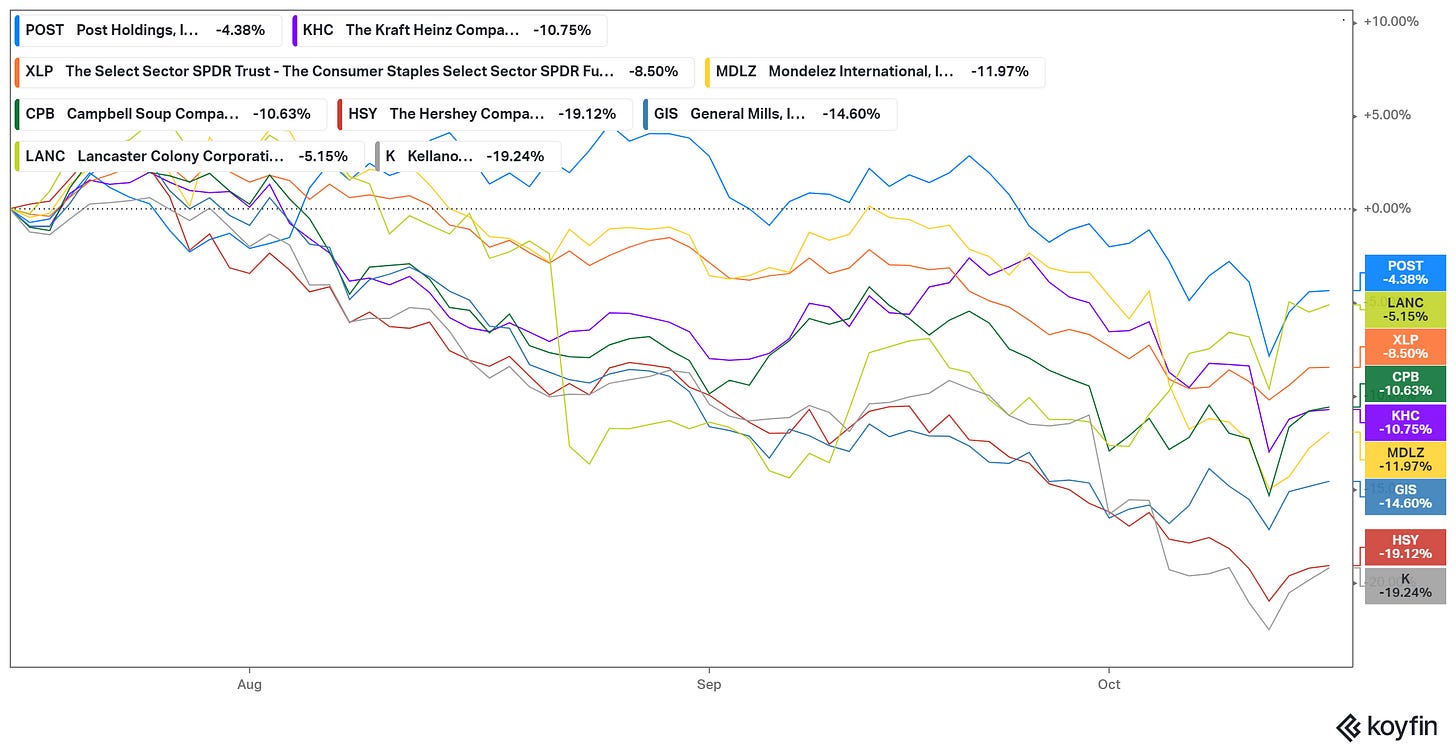

Certainly, they have been so far. Food manufacturers have been some of the worst-performing stocks over the past three months:

source: Koyfin; three-month chart

For this group, there seems a strong possibility that Ozempic has been a significant driver, because there is an apparent relationship between the health of the company’s products and the health of the company’s stock. Mondelez MDLZ 0.00%↑ and Hershey HSY 0.00%↑ are candy manufacturers; Campbell Soup CPB 0.00%↑ and Kellanova K 0.00%↑, the former Kellogg, are heavy into snacks1.

But food manufacturers also highlight the idea that Ozempic is being blamed (or getting credit) for trends that a) were already underway and b) might well have occurred anyway. Food stocks had an absolutely monster 2022: including dividends, the five biggest manufacturers2 provided total returns of 22%, against negative 18% for the S&P 500. Mean reversion hit hard in the first half: again including dividends, the group was down 10.3% while the S&P rose almost 17%. To at least some extent, investors rotated into these defensive names during the “risk-off” sentiment of 2022, then exited as “risk-on” surprisingly returned this year.

Underlying conditions in the industry also played a role. Even as inflation jumped last year, branded food manufacturers were able to take an impressive amount of pricing. But volumes are starting to take a hit, and more broadly the market clearly believes consumers are getting to their limit: we talked just on Monday about the plunge in Topgolf Callaway Brands MODG 0.00%↑, which appears linked to similar concerns about U.S. consumer spending.

There’s another important fact to consider, however: valuations in the space seem to have gone a little nuts. After Q1 earnings in April, Coca-Cola KO 0.00%↑ traded at almost 25x its guided EPS for this year. At the high end of the outlook, 10-year compound annual growth in EPS would be just 2.3% despite a massive overhaul of its business. (Most notably, the company has outsourced most of its botting operations in a bid to improve margins and return on invested capital; to be fair, the stronger dollar has worked against the company over that period as well.). And while Coca-Cola is probably a ‘forever’ business or something close, higher interest rate expectations should play a role. In theory Coca-Cola’s multiple should have compressed this year.

Is It Ozempic?

So there’s a story to tell in which Coca-Cola stock is down 16% from April, and Hershey HSY 0.00%↑ off 19% in three months, because investors are pricing in significant behavioral changes in the customer base, changes driven by Ozempic.

But there’s also a story to tell in which Ozempic is at best a minor contributor to the plunge in food manufacturers so far. There were very real valuation concerns at the top. KO looked overvalued and General Mills (a business with significant, structural, secular challenges in categories like cereal and yogurt) traded at 21x. Even the 19x multiple assigned Campbell looked ridiculous in the context of that company’s long-term track record and product lines.

Bear in mind that, particularly in food, many of these businesses already knew that they were in trouble. General Mills didn’t pay $8 billion to buy pet food manufacturer Blue Buffalo in 2018 because the forecast for its legacy business was bright. Campbell executives aren’t dumb; they knew that canned soup, in particular, was in likely irreversible, secular, decline. That’s why they agreed to acquire Sovos Brands SOVO 0.00%↑ this year, and bought Snyder’s-Lance before that, and in 2012 embarked on an ultimately failed effort to enter the “healthier” category, notably through its acquisition of Bolthouse Farms (along with several other deals).

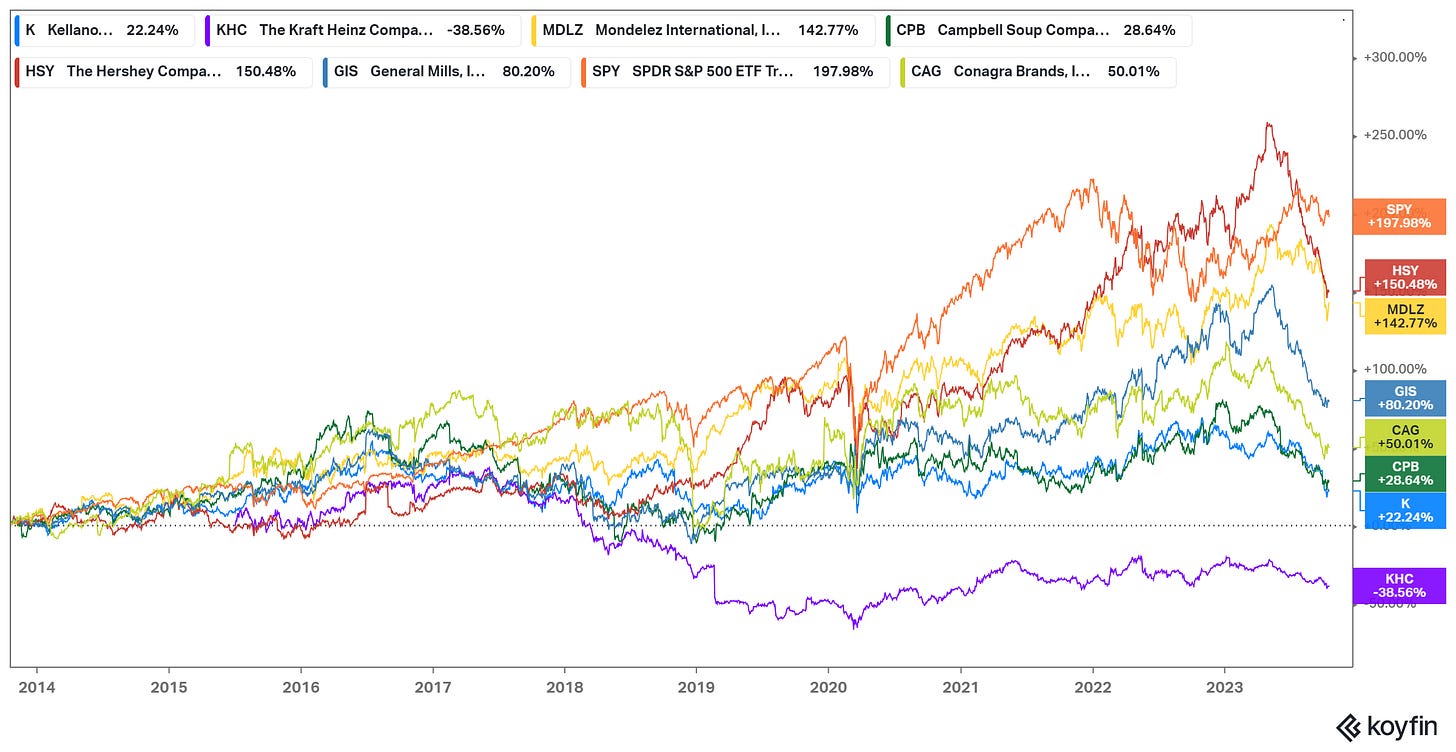

And these are stocks that, on a 10-year basis, have underperformed, and in many cases sharply so:

source: Koyfin

Where the Ozempic plays get interesting is in those names where the impact of GLP-1s is not yet priced in.

Again, it’s not difficult to model a 30%-plus decline for Constellation stock — a leader in a category which is not directly impacted by GLP-1s. What does demand look like for processed food manufacturers? What about Starbucks SBUX 0.00%↑, which now is more a seller of glorified milkshakes than actual coffee?

If the impact of GLP-1s will be significant for super consumers, then many of these exposed names seem to have much further to fall. We’d start that list with the weaker players in any category, whether it’s food manufacturing, fast food, alcohol, or even gambling.

In other words, there are probably some big losers out there and it’s not too late to try and find them. In our next Research Notes, we’ll do just that, while also searching for any potential hidden winners. All told, we think the Ozempic story is only just beginning.

As of this writing, Vince Martin has no positions in any securities mentioned.

Disclaimer: The information in this newsletter is not and should not be construed as investment advice. Overlooked Alpha is for information, entertainment purposes only. Contributors are not registered financial advisors and do not purport to tell or recommend which securities customers should buy or sell for themselves. We strive to provide accurate analysis but mistakes and errors do occur. No warranty is made to the accuracy, completeness or correctness of the information provided. The information in the publication may become outdated and there is no obligation to update any such information. Past performance is not a guide to future performance, future returns are not guaranteed, and a loss of original capital may occur. Contributors may hold or acquire securities covered in this publication, and may purchase or sell such securities at any time, including security positions that are inconsistent or contrary to positions mentioned in this publication, all without prior notice to any of the subscribers to this publication. Investors should make their own decisions regarding the prospects of any company discussed herein based on such investors’ own review of publicly available information and should not rely on the information contained herein.

Campbell acquired Snyder’s-Lance in 2018; after spinning its cereal business into WK Kellogg KLG 0.00%↑, Kellanova gets ~60% of revenue from snacks.

General Mills GIS 0.00%↑, Kraft Heinz KHC 0.00%↑, Campbell, Kellogg, Conagra Brands CAG 0.00%↑

Any data showing SBUX drinks are sugary/milkshakes? Thought it was just a preference change to cold…

Hi, you might check out $LFMD!

https://seekingalpha.com/article/4628828-lifemd-a-derivative-beneficiary-of-the-demand-for-anti-obesity-pharmaceuticals