Highlights:

iRobot’s plunge looks well-deserved. It’s possible there’s a path out, but investors need to hear from management.

SANM had a huge week for reasons that aren’t quite obvious. The long-term case remains intact, but short-term trading may see some volatility.

SMLR has doubled since we first highlighted the name: there’s a case for more upside ahead.

Advantage Solutions is making some smart moves. The path toward a multi-bagger remains open.

So far, we’ve covered 280 different stocks including 88 deep-dive recommendations.

This week we’re taking an opportunity to update some of those names as well as taking a quick look at iRobot.

iRobot Plunges

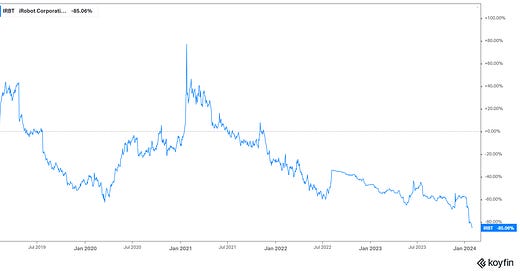

iRobot IRBT 0.00%↑ plunged this week after Amazon AMZN 0.00%↑ (with iRobot’s approval) called off its acquisition of the company, due to regulatory issues. Shares are at their lowest level since 2010 after an absolute collapse:

source: Koyfin; 5-year chart

As is common for companies with a pending acquisition, iRobot has suspended both earnings calls and forward guidance. In other words, beyond press releases and SEC filings, iRobot has not communicated with the market since June 2022. And that’s a problem — because this is a company that really needs to communicate with investors right now. IRBT needs some kind of story — any kind of story — because its fundamentals are absolutely terrible.

Ugly Numbers

Concurrent with announcing the end of the Amazon acquisition, iRobot detailed its operational plan going forward, and included preliminary figures for full-year 2023. The company expects revenue of $891 million, down 43% from the 2021 figure. Adjusted operating loss is guided to about $200 million. On the same basis, iRobot earned $38 million in 2021 and $150 million the year before.

Those losses have ruined the balance sheet. At the end of 2020, cash was $432 million and iRobot had no borrowings. The company expects to end 2023 with a modest amount of net debt — and a troublesome amount of gross debt. iRobot owes $200 million to private equity giant Carlyle Group CG 0.00%↑. The credit facility carries a current interest rate over 14% and almost certainly won’t be prepaid for five years1.

The nature of the creditor is likely more important than the onerous terms. Carlyle’s business of course is acquiring companies. That makes it much more likely (and incentivized) to push iRobot into default as opposed to a bank lender, which would be more willing to do an “extend and pretend” in hopes the business can turn around.

On its face, then, IRBT appears to be a likely zero. But there are a couple of considerations that make the story at least a little more attractive. First, iRobot is getting a breakup fee of about $75 million (net of its own expenses). Nearly all of that money is going to Carlyle, naturally, but it does, for now, push the company into a net cash position.

Secondly, iRobot is slashing costs. 31% of the workforce is being cut, which along with other efficiencies are expected to lower operating expenses by about $150 million annually. Right now, that’s not enough to get the company to profitability, but it’s enough to keep iRobot afloat for a couple of years if sales can stabilize.

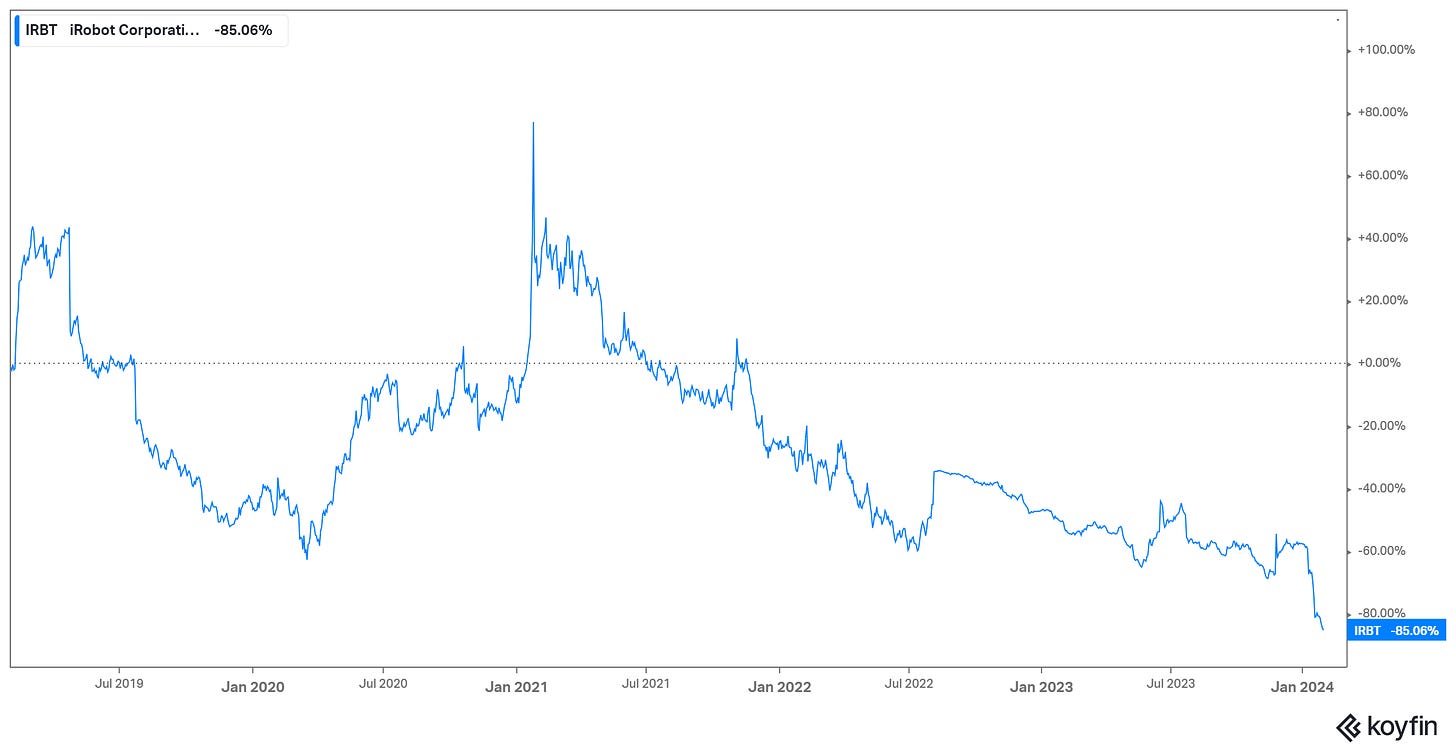

Third, it’s not entirely clear what exactly is going wrong with the business. The multi-year trend here is not that unusual for a consumer-facing company:

source: Koyfin

iRobot saw demand spike in 2020 and 2021 — flush consumers were stuck in their homes which suddenly looked a lot messier. That demand was pulled forward from 2022 and 2023, years which also saw spiking input and labor costs. It’s at least possible that weak results of the last two years were driven primarily by the external environment.

But without management communication, it’s difficult to know if that indeed is the case. Is iRobot dealing with a somewhat standard retail/consumer trend in the post-pandemic environment? Is the problem market share loss to competition? Poor execution?

The answer most likely is a combination of all three, but the specific proportion matters. So does the company’s plan to respond, which creates its own questions.

Does management have a coherent strategy for getting sales back to 2019 levels (36% above the expected figure for 2023) on a cost base that is at least 30% smaller? If not, what’s the mid-term plan here? Surely, the iRobot brand and product line still has some value, yet the stock is trading at ~0.4x revenue, and almost certainly below 1x by the end of this year. It would seem possible that there’s an acquisition out there that makes sense. If not with another ‘Big Tech’ name that will draw the same antitrust scrutiny.

iRobot will, finally, have a conference call at the end of the month. Even with an interim chief executive officer (the chairman and CEO stepped down this week) it will be fascinating to hear what management has to say. Until then, it’s difficult to see what can arrest the long slide in IRBT stock.

Sanmina

Sanmina’s 28% rally on Tuesday looks a little strange. In fiscal Q1 (calendar Q4), Sanmina topped analyst consensus on the bottom line. But revenue was basically as expected (and down 20% year-over-year). Guidance for fiscal Q2 too was about where the Street was and negative year-over-year: the midpoint of the outlook implies a ~19% decline in sales, with adjusted EPS of $1.20-$1.30 versus $1.59 in the year-prior quarter (and $1.30 in FQ1).

Even for those of us who know the story, the reaction to Q1 earnings seems a bit surprising. It seems clear that optimism toward the second half of fiscal 2024 drove the market on Tuesday2. But, for the most part, that optimism existed before the earnings release. Indeed, our argument in recommending SANM last month was precisely that cyclical dynamics within in the industry were set to turn in the company’s favor.

To some extent, the reiteration of that outlook de-risks the story. But that alone doesn’t quite seem to clear the hurdle required for a 28% gain.

source: Koyfin

All that said, the commentary does matter, and it does strengthen the bull thesis heading into the quarter. Chief executive officer Jure Sola on the Q1 conference call said that, in terms of inventory corrections at customers (who built up inventory amid supply-chain worries and now are working it down), “the worst is behind us”. Sola also pointed to benefits from artificial intelligence in the networking and cloud end markets in the second half of this year and beyond. In response to a question about near-term guidance, Sola demurred, but told an an analyst “the longer term, this company is positioned to be a lot bigger than what we just did.”

Confusing syntax aside, the point is clear. And it’s likely the firmness with which Sola, in particular, delivered that message helped drive the big gains in SANM stock. (The company also put its money where its CEO’s mouth was: Sanmina repurchased 3.5% of total shares outstanding, at an average cost just above $50. For now, that looks like an excellent trade.) If Sola is correct, there should be more gains ahead.

SMLR Recovers

Just shy of a year ago, we highlighted Semler Scientific SMLR 0.00%↑.