Research Notes: VeriSign Tanks

One of the market's best businesses tumbles to a multi-year low. Is it a buy?

Highlights:

We update our deep dive on Perficient from this weekend, after reports the company is considering a sale.

VeriSign stock has plunged. Given exceptional fundamentals, the sell-off seems like an opportunity.

If VeriSign can grow registry volume, the stock should be a good investment. But that might be easier said than done.

A Quick Update On Perficient

We pitched IT consulting firm Perficient in our Sunday deep dive. On Tuesday, Bloomberg reported the company had hired advisers and was considering a possible sale. PRFT jumped more than 8% on the report, and is up almost 14% so far this week.

It is good news that the company is in play. But as we wrote on X/Twitter this week, the timing is somewhat curious. PRFT hit a multi-year low last week, and our argument for the stock was that the market was misreading cyclical weakness as secular or competitive pressure. If that’s the case, and if generative artificial intelligence will eventually prove a tailwind for the industry, this seems like the absolute worst time to sell.

That’s particularly true given how steeply PRFT has declined in recent weeks. The stock closed above $72 on February 12th. In this market, businesses can sell, and have sold, well below multi-year highs (PRFT peaked at ~$150 in November 2021), but taking a price seen three months earlier is exceptionally difficult. The issue is $72 represents a 65% premium to the close the day before the Bloomberg report.

So there are basically two explanations here, which lead in completely different directions. The first is that the Perficient board thinks there’s a possibility of a huge premium to Thursday’s close below $49, because it likely will take that kind of premium for shareholders to approve a sale. (The board has no advantage in the vote, either. Insider ownership is exceptionally thin: barely 2% of shares outstanding across all executives and directors.) Based on where the stock has traded, most active investors who bought the stock this year, let alone before that, believe that PRFT is an $80-plus stock (myself included). It should take that kind of offer for the board to even listen.

The bearish interpretation, however, is that the board does think there’s something going on here beyond cyclical weakness, whether that’s risk from genAI or something else. To be sure, given the pace of corporate strategic movements, the decision to explore a sale (which Bloomberg, emphasized was not guaranteed to happen) was likely made with the stock higher than it traded earlier this week.

Even so, after management has spent multiple quarters arguing that the company’s problems are external and cyclical, it would be an obvious red flag if the board thought it was wise to have a strategic alternatives process when its executives themselves are saying the cycle hasn’t turned yet.

For now, the decision seems logical (and, again, far from binding). As the report correctly noted, there are multiple parties with potential interest, whether strategic buyers or private equity. Rivals are positioning for genAI, and as a result may have reached out informally to gauge Perficient’s interest. Private equity funds still have plenty of capital to put to work. As such, a big premium to the current price absolutely is in play.

But between the chart and the fundamentals, PRFT is a classic case where the clear risk is that there is something the bull case simply isn’t accounting for. That risk does seem magnified just a bit here. The simplest thing for the board to do here would be to wait. It remains to be seen whether they’re being proactive to take advantage of an opportunity, or to avoid a risk. We’re still happy betting on the former.

VeriSign: The Best Business No One Is Talking About (Or Buying)

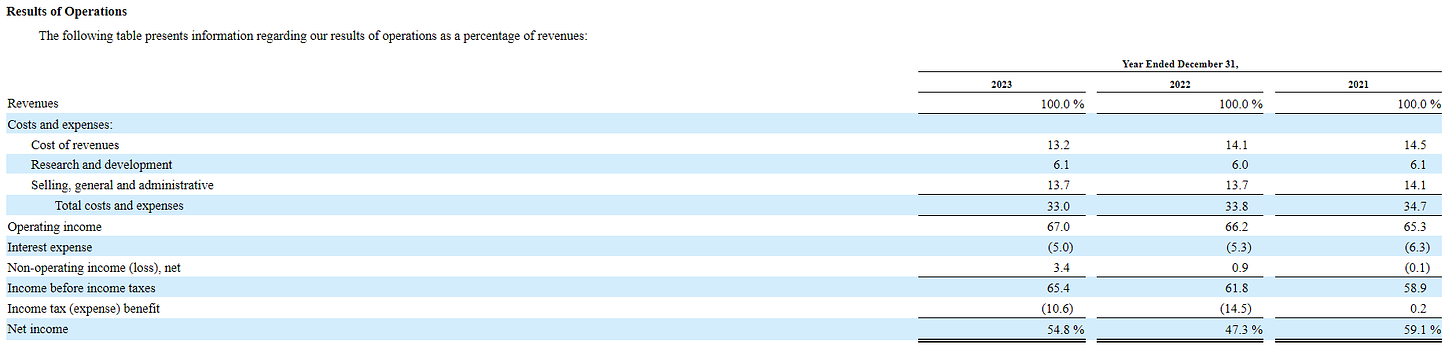

There is a legitimate case that VeriSign VRSN 0.00%↑, the registry for .com and .net Internet addresses, is one of the best businesses on U.S. exchanges. Its return on invested capital, per a Koyfin screen, is the highest in the entire market, in part because current assets are negative; suppliers fund the business’s capital needs. VeriSign’s net income margins, on a normalized basis and focusing solely on operating businesses, have few peers. The overall margin structure in 2023 looked like this:

source: VeriSign 10-K

It’s not a coincidence that VRSN was one of the first tech buys from Berkshire Hathaway, back in 2013. Berkshire still owns almost 13% of the company.

Meanwhile, this has been a market in which investors have been rewarded for paying up for the best businesses. And yet, for some time now, VRSN has been a dud:

source: Koyfin

The underperformance is all the more stark given that VeriSign has been aggressively repurchasing shares. While VRSN stock is down almost 14% over the past five years, its market cap has declined more than twice as much.

It’s not as if the business has struggled. Between 2019 and 2023, net income rose at a 7.5% annualized clip, thanks in part to a 500 basis point expansion in net margins. Rather, it’s been the multiple investors are assigning to future earnings that has been the problem:

source: Koyfin

Is VRSN Cheap?

21x earnings perhaps isn’t that cheap. And there is a bit of a catch in using a four-year growth rate.