Highlights:

Griffon Corporation is a well-run business that owns the largest manufacturer of garage doors in America. Shares are up 56% over the past 12 months.

There are questions about management. But an activist campaign by Voss Capital in 2021 led to some changes, including board appointments and a strategic review.

Even with pressure on margins, Griffon has a simple path to 40% upside, and much more in a blue-sky scenario.

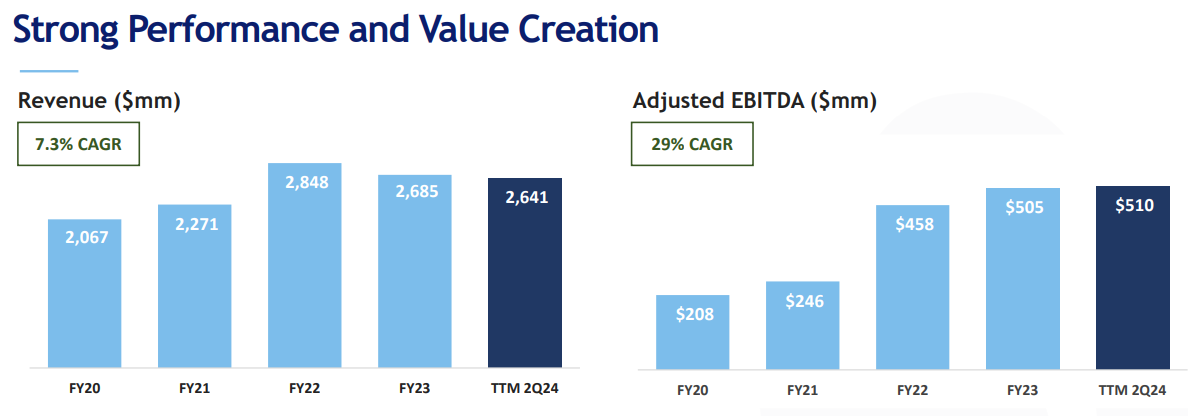

There are two potential problems with the bull case for Griffon Corporation GFF 0.00%↑. The first is highlighted by a slide from the company’s own investor presentation:

source: Griffon investor presentation, May 2024

While revenue has increased since the pandemic, the obvious catalyst for profit growth has been a massive increase in margins. EBITDA margins expanded from 10% in fiscal 2020 (ending September) to 19.3% on a trailing twelve-month basis. In an environment where building products manufacturers have been able to take price, the obvious concern is that margins will revert to the mean, bringing profits with them.

The second issue is that at least some of that margin expansion remains priced into GFF shares:

source: Koyfin

And so there is not just a potential bear case here, but perhaps a potential short case. It’s the kind of short case that worked well in 2021-2022, as post-pandemic margins normalized. The combination of lower profits and a reduced multiple drove substantial gains for shorts that timed their trades correctly.

Given current valuation, and a 20% decline from recent highs, clearly some investors fear a similar outcome for Griffon. In fact, more than a few traders have put money behind the bear case: over 6% of the float is sold short, a position totaling about $170 million.

But in Griffon’s most important business there’s little sign of that margin normalization, and looking at peers some evidence that newfound pricing power can and should stick. In the company’s weaker segment, margin normalization (and then some) has already arrived, and Griffon has an aggressive plan to turn that business around.

Overall, then, margins should remain intact. Given the nature of the business and the current valuation of the stock, that alone is more than enough to drive impressive upside.

source: Clopay/Griffon