Programming note: we’re doing something a little different this week with a deep dive on Yelp. If you like this type of content, let us know in the comments.

Introduction

Yelp is one of the least covered mid-cap companies, and the reason is simple: It’s perceived as a boring company. Although that statement isn’t far from the truth, there’s also a lot to learn from it.

Yelp was founded 2 decades ago (in 2004), by Russel Simmons and Jeremy Stoppelman, two former PayPal employees and today it’s one of the leading sources of user-generated reviews and ratings for businesses.

How it started is definitely a unique story. Stoppelman caught the flu and struggled to find online recommendations for a local doctor. So, it started as an email-based referral network. Users would e-mail requests for business recommendations to friends, who could reply with their suggestions. The responses would be collected and organized to create a user-generated database of users.

The name “Yelp” was chosen as a combination of “yellow pages” and “help”, and it is a great choice, given it is short, memorable, easy to spell and many were already familiar with yellow pages. However, having a good name wasn’t enough, and the company struggled to scale beyond close family members. The reason was simple – Not many were enthusiastic about answering e-mail referral requests.

However, the founders noticed that the “Real Reviews” feature, which allowed users to write reviews anytime they wanted, without anyone requesting them, was used often. So, in 2005, they rebranded, raised $5m in funding, and the beginning of the growth started. Only 4 years later, in 2009, Google offered to acquire Yelp, but the two parties didn’t reach an agreement. The rumours are that Google offered $500m, while Yahoo offered $1 billion, which Google refused to match.

The company continued its expansion outside of the US and became a public company in 2012. Today, its market cap is ~$2.5 billion and it’s one of the largest crowd-sourced local business review sites. With $262 million of TTM free cash flow the stock is valued at around 10x FCF.

How Yelp Makes Money

As customers share their experiences through reviews, Yelp becomes a gold mine (if data is considered to be gold). This has allowed the company to develop a few different revenue streams over time:

Advertising (~95% of all revenue)

Transaction-based (~1% of all revenue)

Other (~4% of all revenue)

1. Advertising & Business-page products

With all the traffic to their website, Yelp has a range of advertising products, that provide the ability to deliver targeted advertising to large and high-intent audiences. High-intent is the key characteristic. There are two key advertising products:

CPC Advertising (“Yelp Ads”) – Performance-based ads

Multi-location Ad products – A range of ad products, designed for multi-location advertisers, including: Showcase Ads, Spotlight Ads and Yelp Audiences. The company also provides a first-party attribution solution (“Yelp Store”) which provides insights into how Yelp Ads drive physical store foot traffic.

In addition, Yelp offers business-related products:

Any business has the ability to create a free account and claim a Yelp page for each of their business locations. Once claimed, it can update its listing information and has the option to purchase certain packages that offer features, such as:

Removing competitor ads from the business’s page

Update listing information and select photos to highlight on the page through a slideshow feature

Verified license indicating that Yelp has verified the business’s trade license and confirmed it as in good standing as of a certain date

A portfolio that showcases the work or services offered

Yelp Connect, offering a channel to market new offerings, or communicate business updates to their customers.

Nearby jobs – providing businesses with the ability to see a dynamic feed of job quote requests in their area of business.

2. Transactions

Yelp facilitates transactions between consumers and businesses, primarily through partner integrations. The largest partner is Grubhub, which allows consumers to place food orders for pickup and delivery through Yelp.

3. Other Revenue

In addition, Yelp is able to monetize via the following products:

Yelp guest manager – A subscription-based suite of front-of-house management tools for restaurants, nightlife and certain other venues. The tools provided include online reservation, a waitlist management solution, as well as seating and server rotation management tools.

Yelp Knowledge – Offering local analytics and insights, through partnerships with companies such as Sprinklr and Chatmeter.

Yelp Fusion – Enables developers to build products that include Yelp’s high-quality content and data. Partners include Apple, which makes the content available through Apple Maps (and Siri), as well as auto manufacturers like Audi AG and BMW. The typical license agreement is multi-year, with rates determined based on type and volume of usage.

Other partnerships such as content licensing and allowing 3rd party data providers to update and manage business listing information on behalf of businesses.

Key Metrics

There are many metrics that the company discloses. Let’s have a look at them one by one.

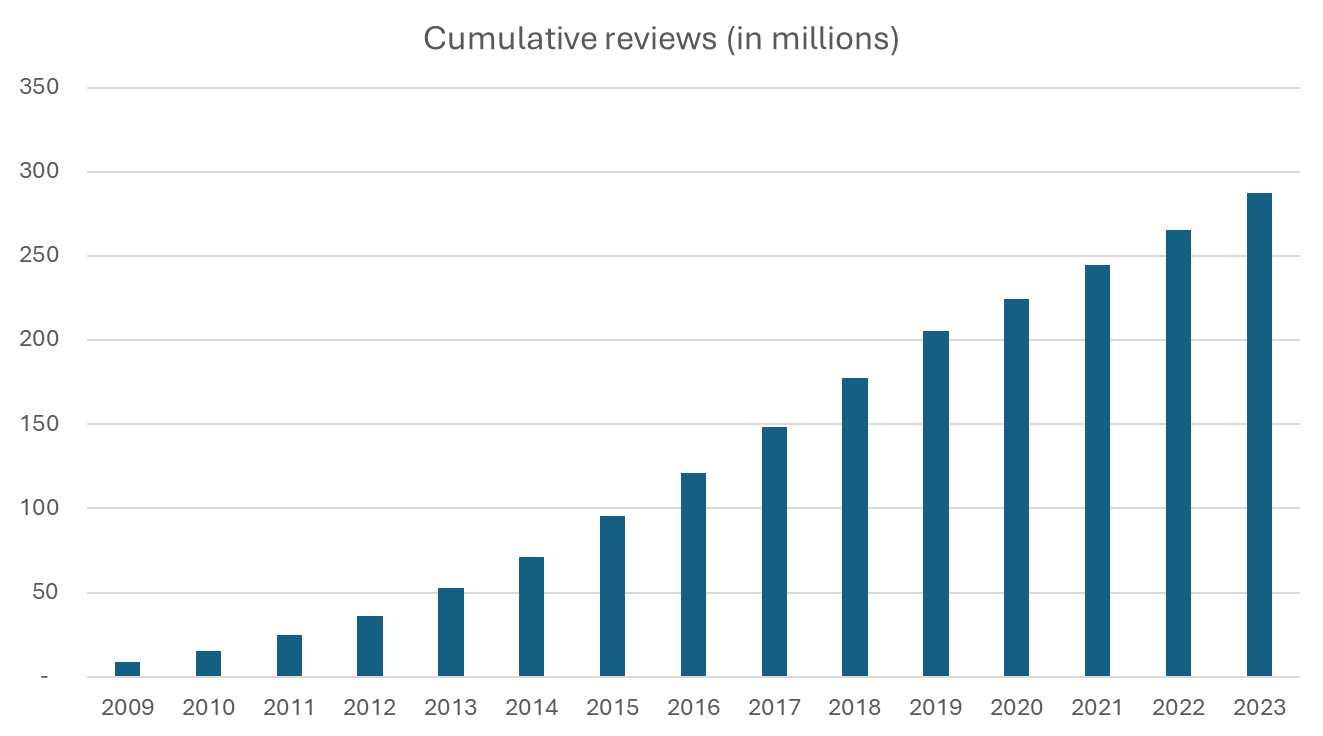

Cumulative reviews (in millions)

The growth in reviews is definitely impressive and one of the reasons why individuals go to Yelp. However, I’ll argue that the cumulative reviews isn’t the metric to follow.

There’s a threshold above which, an additional review doesn’t add additional value. One doesn’t feel more comfortable buying a product with 3,500 reviews than buying a product with 3,000 reviews. In addition, having a cumulative metric will always seem impressive, as the number will always go up.

Instead, a better metric would be # of reviews per year. This chart paints a different picture:

Although this could seem worrying, a case can be made that this metric also doesn’t add much value. As humans, a lot of our experiences are repetitive. If you go to a restaurant, and you really like the food, you might give a good review and visit it again. However, when you visit it again, there’s no point in sharing the same review again, unless, of course, your experience was significantly different. Having repetitive experiences would lead to fewer reviews, assuming the # of users is stable.

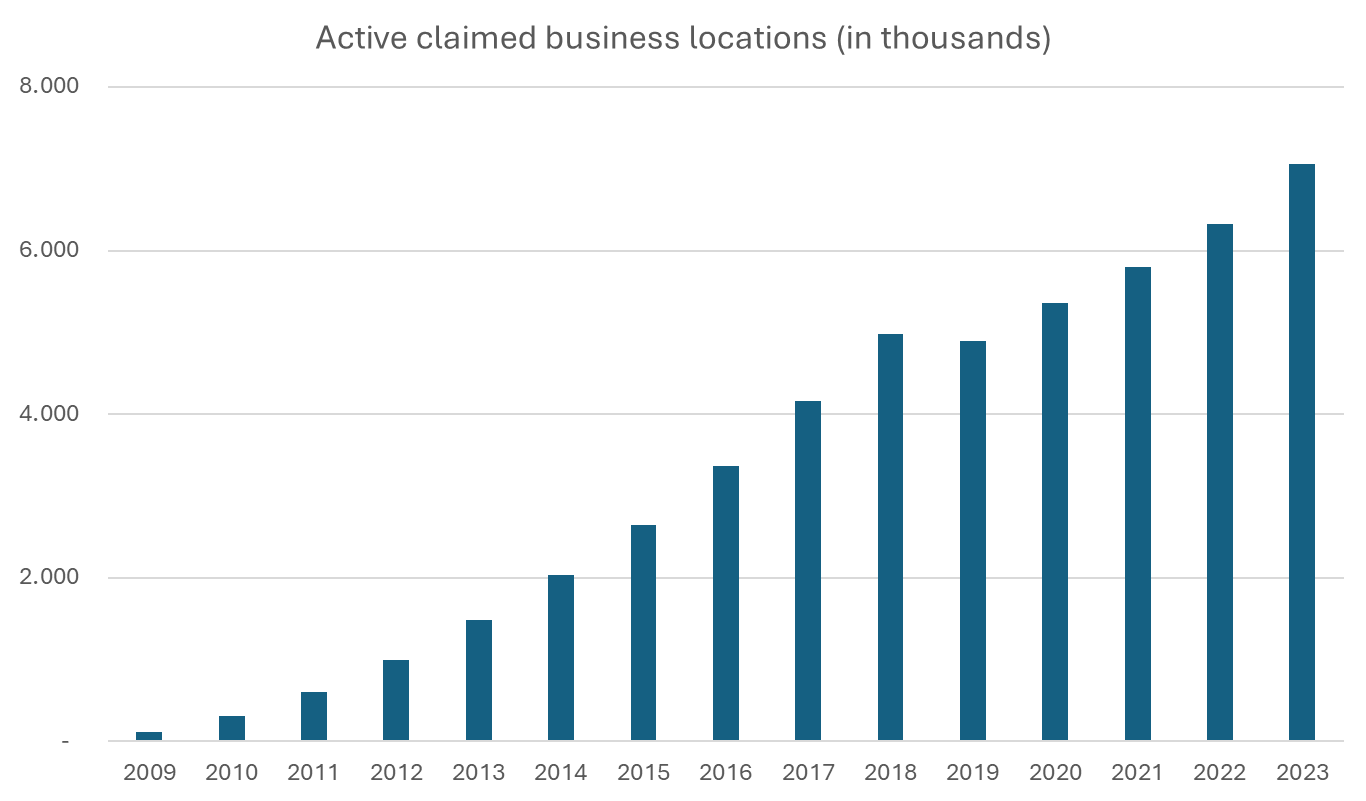

Active claimed business locations (in millions)

The # of active claimed business locations continues to go up, which is great. Yelp is the place to be for anyone starting a business.

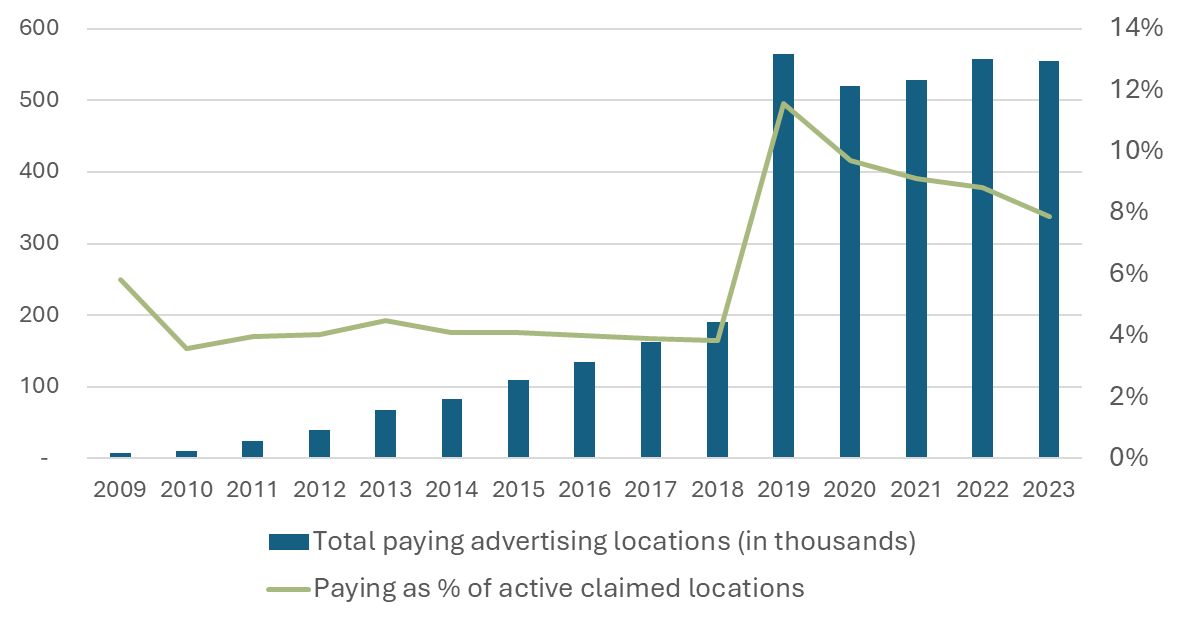

Paying advertising locations (in millions)

However, the number of paying advertising locations hasn’t been growing over the last 4 years.

So, although there are more businesses on the platform, there aren’t more businesses that are paying to advertise. The company benefited a lot from the pandemic and is now experiencing somewhat of a normalization.

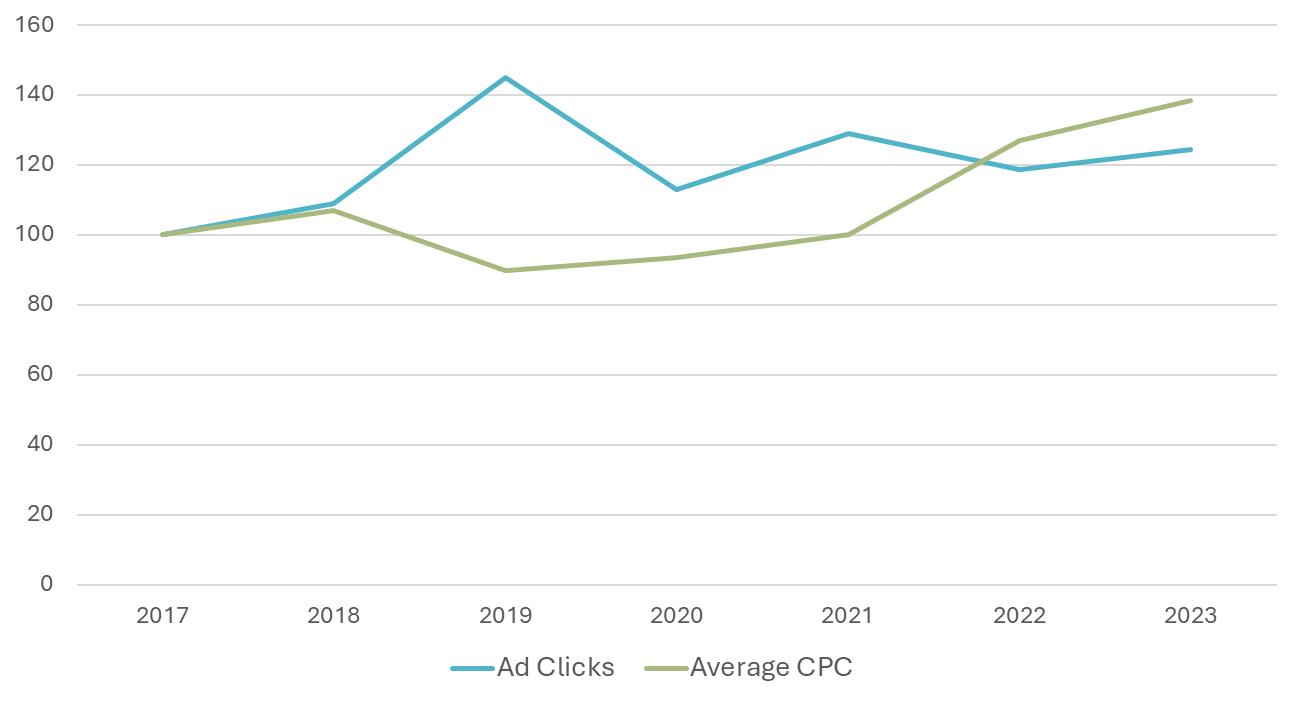

Ad clicks & CPC (Cost per click)

Yelp doesn’t report the ad clicks or CPC, but the company does report the change YoY. If 2017 = 100, here’s how both of these metrics have changed over the last 4 years:

Over this time period, the Ad clicks is up 3.7% per year (25% in total), while the CPC is up 5.6% per year (38% in total). However, as of 2019, the number of Ad clicks has been going down, which could indicate that future growth can only be expected by an increase in cost per click. Therefore, the average annual growth would be below 6%, assuming the CPC can grow at the same pace. So, it’s important to note that the advertising revenue isn’t the safest. In difficult times, especially when there’s a recession, companies reduce their marketing spend, as consumers are spending less.

Historical Financial Performance

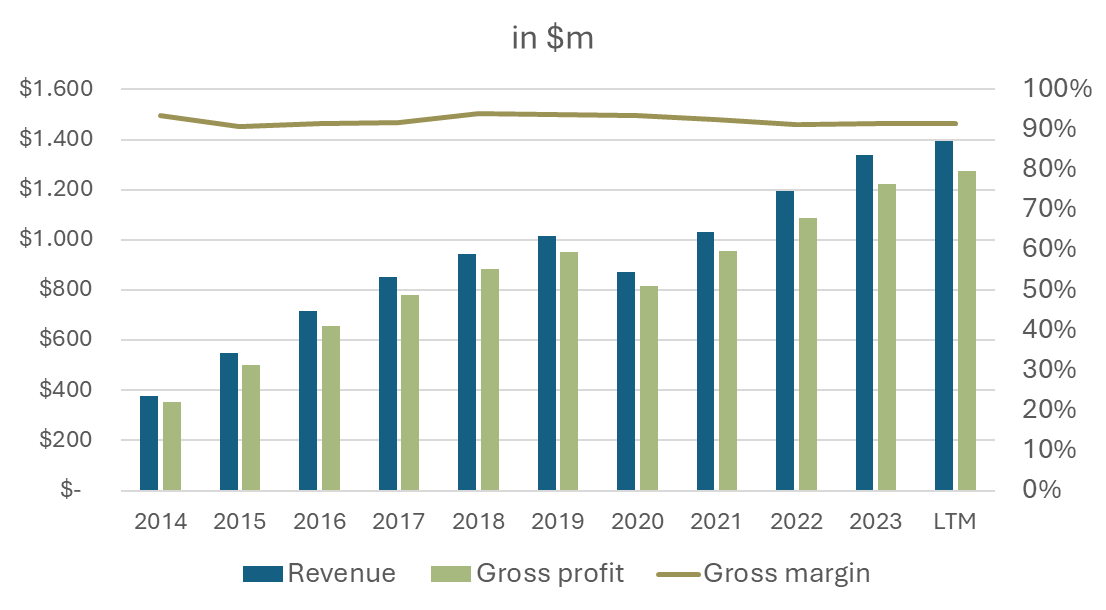

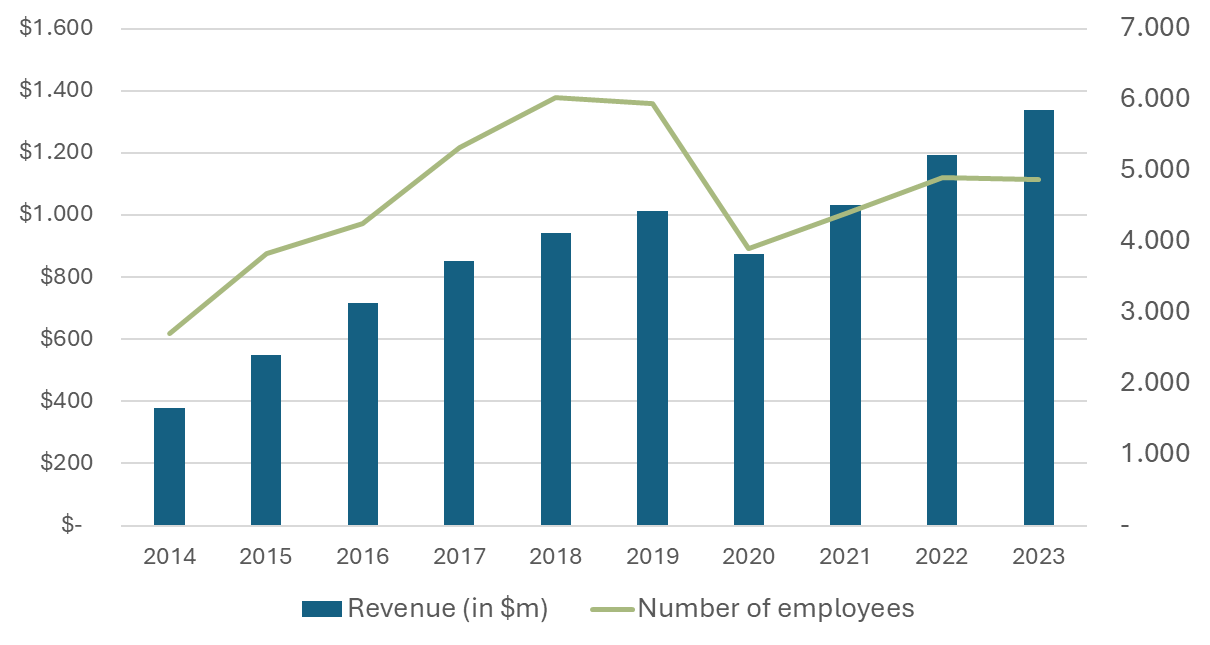

The company’s revenue has been growing and its gross margin is above 90%, as its direct costs are limited to:

Website infrastructure (hosting and employee costs for the infrastructure teams)

3rd party advertising fulfillment costs and;

Credit card processing fees.

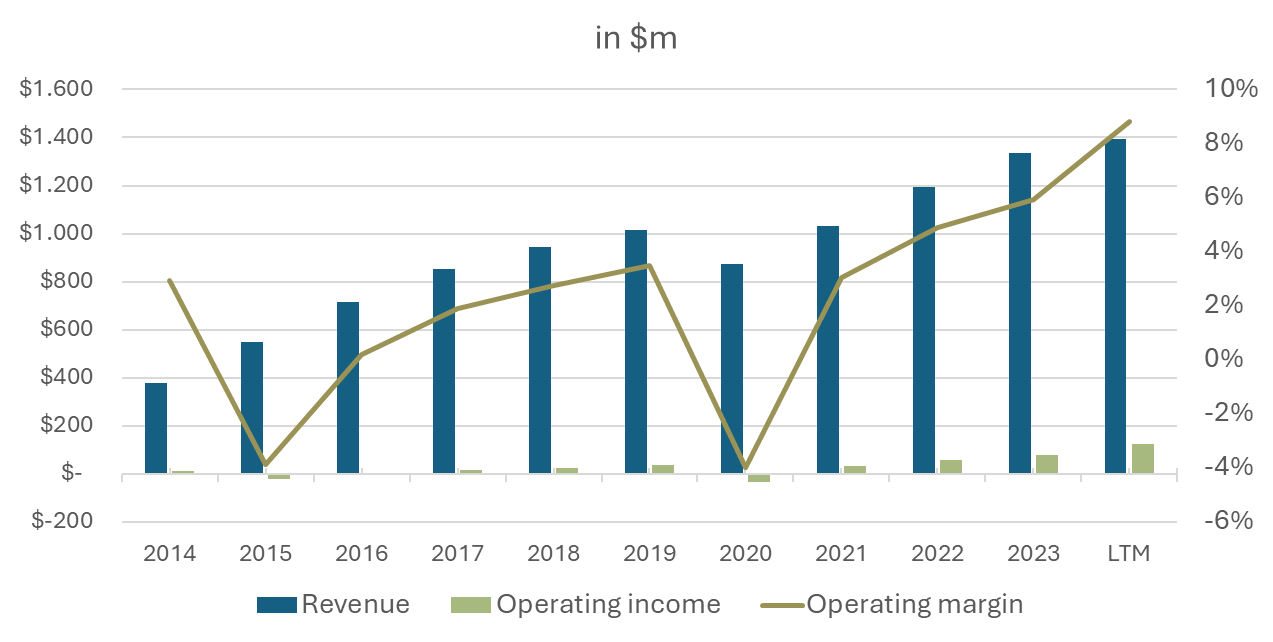

It’s operating margin has been growing over time, and now stands at 9%. Part of this is due to economies of scale, and part of it is due to the company’s commitment to be fully remote, as of 2022. That allowed a reduction of office footprint and lower workplace operating costs.

Although the margin has been increasing recently, there’s still a lot of room for improvement and the journey to profitability is on its way.

This is a great example of a company that can utilize economies of scale. The number of employees has been growing at a lower rate than its revenue, leading to higher revenue per employee.

Competition

A crucial part of valuing Yelp is considering its competitive environment. One can argue that it competes with Google Reviews, TripAdvisor, Craigslist, Airbnb, OpenTable, Angi, Resy, and even TikTok and Instagram.

These are not new competitors, so Yelp’s performance is based on the current competitive environment. The question is – Can there be such a change, that would significantly impact Yelp’s business model? Currently, the only risk I see is CPC pressure.

Acquisitions

The company occasionally engaged in acquiring smaller companies with the average purchase price being $50 million. Since becoming public, they’ve used less than $500 million on acquisitions, one of which (Eat24), was sold to Grubhub.

Stock Repurchase Program

As of September 30th, 2024, the company’s board of directors had authorized the company to repurchase up to $1.95 billion of its common stock. Out of that, $393 million remained available. Given the company’s market cap of $2.5 billion, one might expect that this led to a significant reduction of shares outstanding. Since 2017, the number of shares outstanding is down by only 17%, and the main reason for that is share-based compensation.

One interesting observation is that the company repurchased the least amount of shares during 2020, when the share price was the lowest.

Additional Information

In addition to what has been discussed so far, there are some other factors worth consideration…

Astroturfing

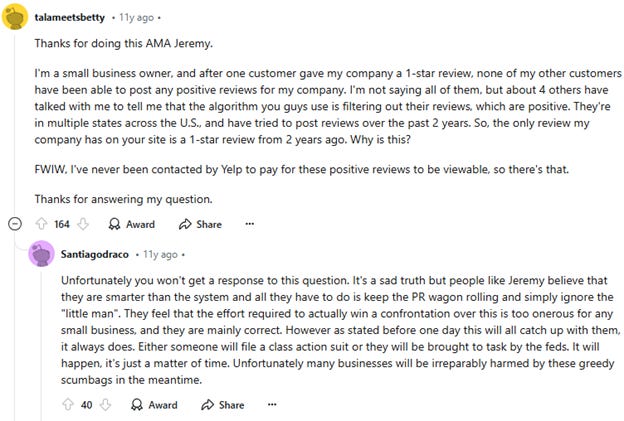

As yelp has been growing, fake reviews, known as “astroturfing” became more frequent. A study from Boston University came to the conclusion that the percentage of fake reviews rose from 6% in 2006, to 20% in 2014. To combat this, Yelp has its own proprietary algorithm, that the New York Attorney General Eric T. Schneiderman said was the most aggressive out of the crowd-sourced websites he looked into. Yelp has been criticized for not disclosing how the filter works although, if revealed, it could contain hints on how to defeat it.

Alleged unfair business practices

There have been allegations that Yelp has manipulated reviews based on participation in its advertising programs. Many business owners have said that Yelp salespeople have offered to remove or suppress negative reviews if they purchase advertising.

Several lawsuits have been filed against Yelp, and each one has been dismissed by a judge before reaching trial.

Business Insider investigation

In November 2020, Business Insider shared a report, that highlighted allegations of a high-pressure sales environment, with claims that sales representatives employed aggressive and sometimes misleading strategies to meet targets. These practices reportedly included pressuring businesses to purchase advertising to mitigate the impact of negative reviews. Additionally, the investigation shed light on ethical concerns within the company, such as heavy drinking and inappropriate behavior among staff. These revelations raised questions about the company's internal ethics and the pressures faced by its employees.

Jeremy Stoppelman’s Reddit AMA

Back in November, 2013, Jeremy Stoppelman decided to do an AMA on Reddit.

Almost all of the questions were negative, such as the following one:

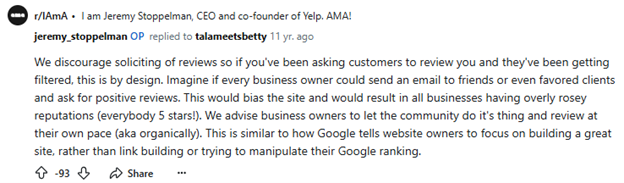

A significant portion of his responses were downvoted, and some of them by a big margin, such as this one:

The following comment was one of the most up-voted:

Of course, this AMA was quite a long time ago, but it’s worth mentioning.

Valuation

Here’s what a bull-case looks like: